Creating an app for a microfinance organization

Application for MFOs

Android & IOSApplication for MFOs Android & IOS

More and more people prefer to apply for loans not from banks, but from microfinance organizations. And this is not surprising, because they offer a more convenient procedure for issuing loans, clear terms of service and high speed of decision-making.

Typically, the user only needs to fill out a short form, and within a few minutes the requested amount will be available on the card. We will tell you in this article exactly what tasks the mobile application solves in the microcredit niche and what you will need to launch it.

Why MFOs should invest in mobile application development

Advantages of a mobile applicationWhy MFOs should invest in mobile application development Advantages of a mobile application

First, let’s look at why developing a mobile application for microfinance organizations is so important:

- Ease of use. Through the app, users can access financial services anytime, anywhere. This helps to increase customer satisfaction and loyalty.

- Effective scoring. Mobile applications allow you to implement automated credit assessment systems. Algorithms for analyzing data and a client’s financial history can make a decision on issuing a loan in a matter of minutes. This not only speeds up the process, but also reduces the risk of human errors.

- Process automation. Automation using the application also reduces the operational burden on staff, reduces the time for processing requests and increases the efficiency of the microfinance organization.

- Expanding the audience. Among other things, the application opens up new channels for attracting customers, especially among the younger generation, who prefer to use mobile devices for financial transactions.

- Analytics. Using a mobile application, a microfinance organization can receive up-to-date analytical data online and use it for successful business planning.

The main functionality of the application for microfinance organizations

FunctionalityThe main functionality of the application for microfinance organizations Functionality

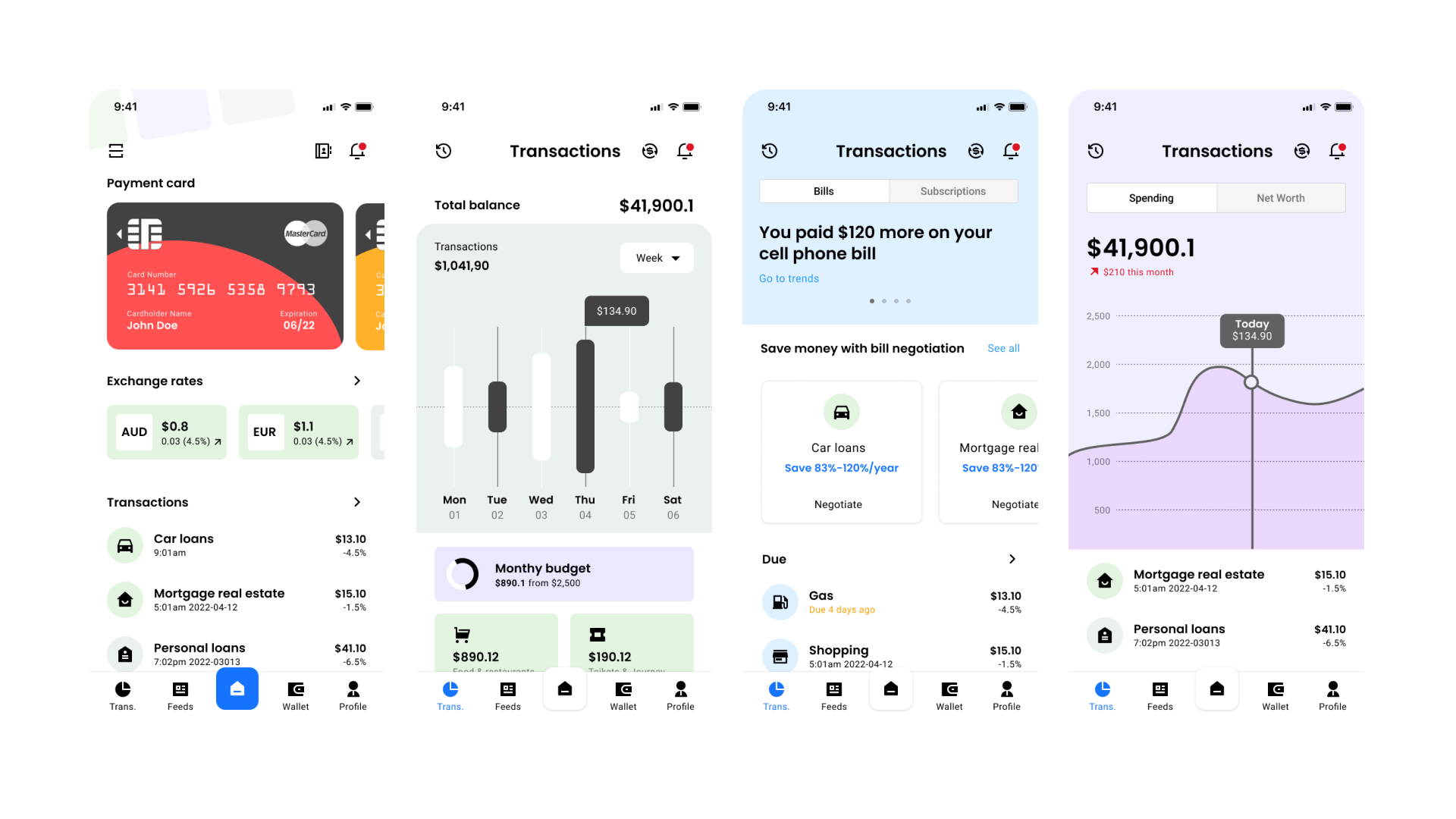

An application for microfinance organizations may contain many features aimed at improving user experience and increasing security, and depending on the business model and marketing strategy, the functionality may differ significantly. In this article, we propose to consider the basic modules necessary to bring an MVP to the market:

- Registration and authorization. Ability to create an account for new users.

- Authorization. Quickly login to the application using various methods such as email, phone number, social networks or biometrics.

- User profile. A personal account in which the user can manage personal information, view loan history, repayment schedule and application status.

- Application for a loan. A comfortable and intuitive interface for creating new loan applications, with the ability to select the amount and loan term. It would also be a good idea to add an interest calculator so that the client can immediately see how much he will have to pay for servicing the contract.

- Credit assessment. Calculation and display of the possible loan amount depending on the user’s credit history.

- Notifications and alerts. The Push Notification module is necessary to inform users about changes in the status of an application and send reminders to make monthly payments. These messages can also be used to implement marketing strategies to retain customers.

- Payment calculator. Calculation of monthly payments depending on the selected amount and loan term.

- Interface for support. Chat with a credit manager for advice and assistance.

- Analytics and reports for MFOs. Analysis tools for assessing the performance of a microfinance organization.

How the application development process works

Development stagesHow the application development process works Development stages

The development of a mobile application for microfinance organizations includes several stages, each of which plays a key role in creating a successful product. Let’s take a step-by-step look at how the development process is organized in our team:

- Collection of information. We study the client’s business processes, conduct research on the target audience and competitors, and then determine key tasks.

- Prototype. Mobile app design is a critical step in development that helps define the structure, functionality, and appearance of the product. The result of this stage is a carefully thought-out prototype, which will become the basis for the entire further development process.

- Design creation. When developing a mobile application design, we focus on intuitiveness and attractiveness, and also pay attention to detail to enhance the overall visual perception of the application.

- Frontend development. This is the client side of the application that users interact with on their devices. To implement it, we most often use the cross-platform Flutter framework, but if necessary, we can also use native technologies: Swift for IOS and Kotlin for Android.

- Backend development. This is the server part of the mobile application, responsible for data processing, business logic and interaction with the database. The backend provides functionality that is invisible to the user, such as request processing, user management, security, and data storage. For its technical development, we use different technologies for modems, for example, Python, PHP, Java languages or Django, Flask, Laravel frameworks.

- Testing. This stage helps to identify and eliminate bugs, check the correct operation of the functionality, adaptation to various devices and screen resolutions.

- Support and development. Post-release support includes regular application updates to fix bugs, ensure compatibility with new devices and operating systems, as well as develop the project’s functionality.

Mobile development

in AVADA MEDIAMobile development in AVADA MEDIA

Mobile applications play an important role in the development of microfinance organizations. They help automate internal processes, improve the quality of customer service and attract new audiences, due to which the growth rate of microfinance organizations significantly increases.

Our team has extensive experience in developing Fintech solutions and will help you launch an effective business application. If you are ready to act now, fill out the feedback form and we will contact you to discuss the project.

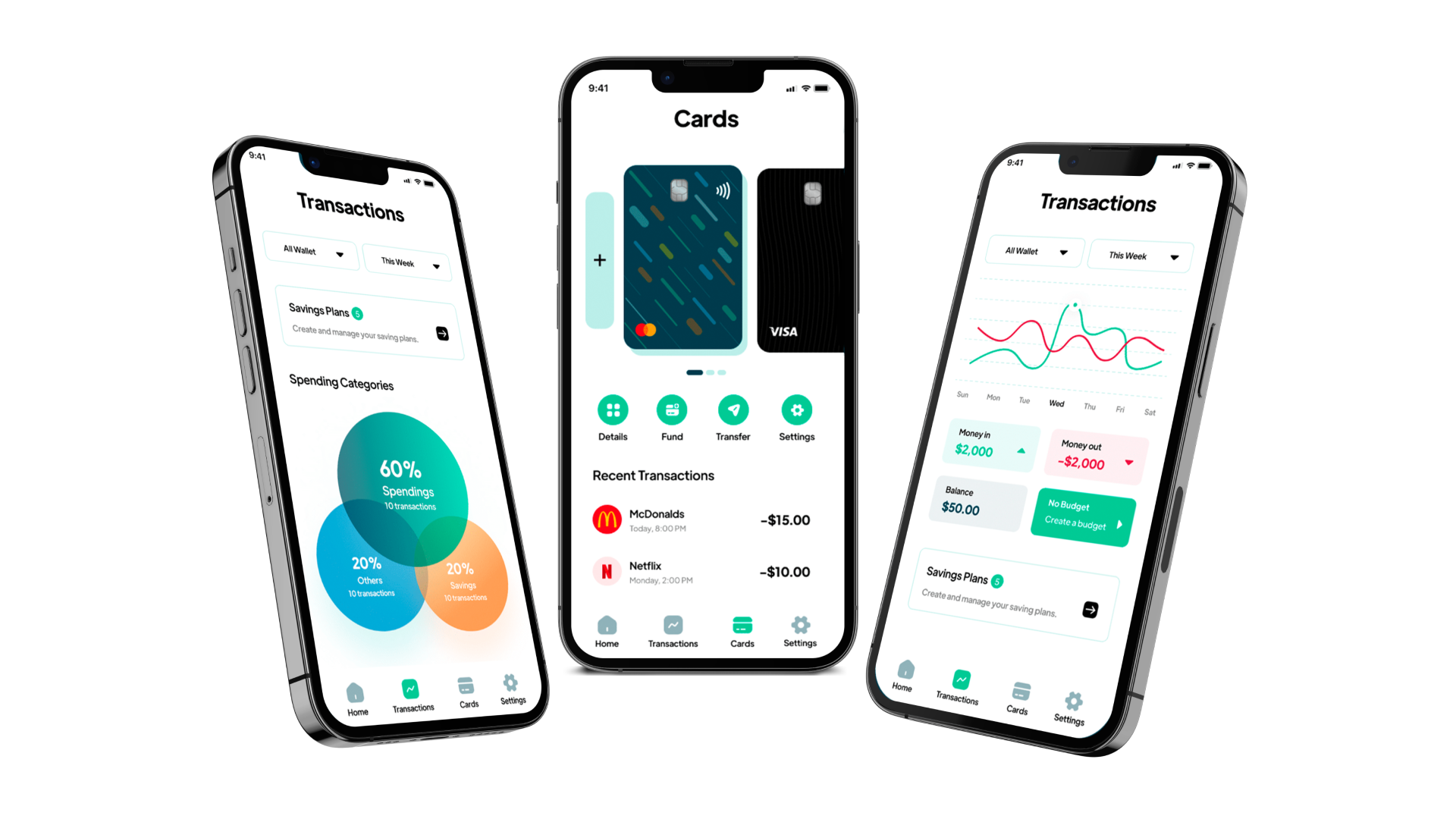

Fresh works

We create space projectsFresh works

The best confirmation of our qualifications and professionalism are the stories of the success of our clients and the differences in their business before and after working with us.

Our clients

What they say about usOur clients What they say about us

Successful projects are created only by the team

Our teamSuccessful projects

are created only by the team Our team

Contact the experts

Have a question?Contact the experts Have a question?

-

Phone:+ 38 (097) 036 29 32

-

E-mail:info@avada-media.com.ua