Development of DEFI aggregators

What is a DEFI aggregator?

Aggregator DEFIWhat is a DEFI aggregator? Aggregator DEFI

It is often difficult for the average user to understand and learn the intricacies of trading across multiple platforms and protocols. DeFi aggregators solve this problem by providing the best deals in one place. Moreover, they provide the ability to build successful strategies without having to understand the intricacies of DeFi trading and the coding required for many platforms. The use of aggregators gives users the confidence that they always get an effective strategy for their trades.

A DeFi aggregator is a platform that brings together trading across various DeFi protocols in one place. As the DeFi market continues to thrive and expand, new protocols appear within weeks, if not days. They are distributed across various blockchains, making it difficult for users to find the best protocol to use. DeFi aggregators save users time and increase their efficiency in finding protocols that suit their needs by bringing all the information together.

Types of DEFI aggregators

Types of DEFI aggregators

DEX aggregators

DEX aggregators (1inch, Paraswap, Matcha, Uniswap, Curve, SushiSwap, Bancor) help in cost optimization from many decentralized exchanges.

Lending and borrowing aggregators

Lending aggregators (Compound, Aave, Liquidity, Hundred finance) optimize the best yield of loans and credits from various decentralized lending protocols.

Yield aggregators

Leveraging all of Defi’s yield generating protocols (lending, liquidity provision and liquidation), yield aggregators (Yearn Finance and Alpha Finance) represent strategic vaults optimized for revenue generation in the Defi ecosystem (leverage farming).

Cross chain aggregators

Using various inter-chain bridge protocols, such aggregators (Li.finance) optimize swaps.

How can DEFI aggregators be useful for business?

How can DEFI aggregators be useful for business?

Convenience

DeFi aggregators collect the best opportunities and prices from DEXs, lending services, and liquidity pools in one place so users can optimize their trades. Without an aggregator, they have to go to each platform individually to compare the prices that will provide the best deal. Each trade is then executed manually using smart contracts. This strategy may be suitable for everyday cryptocurrency trading, but it severely limits those who want to implement advanced trading strategies.

Aggregators not only collect the best prices, but also offer a unique, convenient way to analyze and combine the trading strategies of other users through a convenient drag and drop mechanism. Thus, users can create a completely new strategy on their own, using other successful traders as inspiration. The drag and drop mechanism also helps users visualize complex DeFi protocols with blocks that can be built on top of each other.

Liquidity

DEXs offer a greater degree of decentralization, but since they are new to the blockchain market, the liquidity pools on each are smaller, especially when compared to CEXs. Therefore, with a large trading volume, the price may move significantly (large slippage) or simply fail to complete the transaction. Thus, combining several DEXs into one aggregator creates the conditions for better liquidity.

Prices

An aspect associated with low liquidity is slippage. When users trade, they end up buying or selling assets at a price that is significantly different from what they intended. With large trade sizes, this difference is quite noticeable and can make a trade less profitable or more unprofitable. With the best liquidity, price slippage is minimal, as even large orders rarely cause a sharp price change.

Safety

DEX is much better than CEX in terms of privacy and secrecy. Users do not store their assets in wallets on the site, thereby maintaining full control over their property and not risking losing everything as a result of a hacker attack.

Trading conditions

Traders conducting transactions within one platform are usually limited by the conditions that exist on it. Therefore, they basically have to settle for current prices rather than go through the hassle of registering on other platforms. With the aggregator, users always have access to the best price offers on multiple DEXs, choosing where to trade at any given moment to get the best prices.

How is the development of DEFI aggregators carried out?

How is the development of DEFI aggregators carried out?

Collection of information

This stage is necessary for a detailed study of the goals and requirements of the project in order to create a worthwhile product. Our development team and the client communicate together to determine the scope, budget, and timeline, developing a detailed roadmap for building a DeFi aggregator.

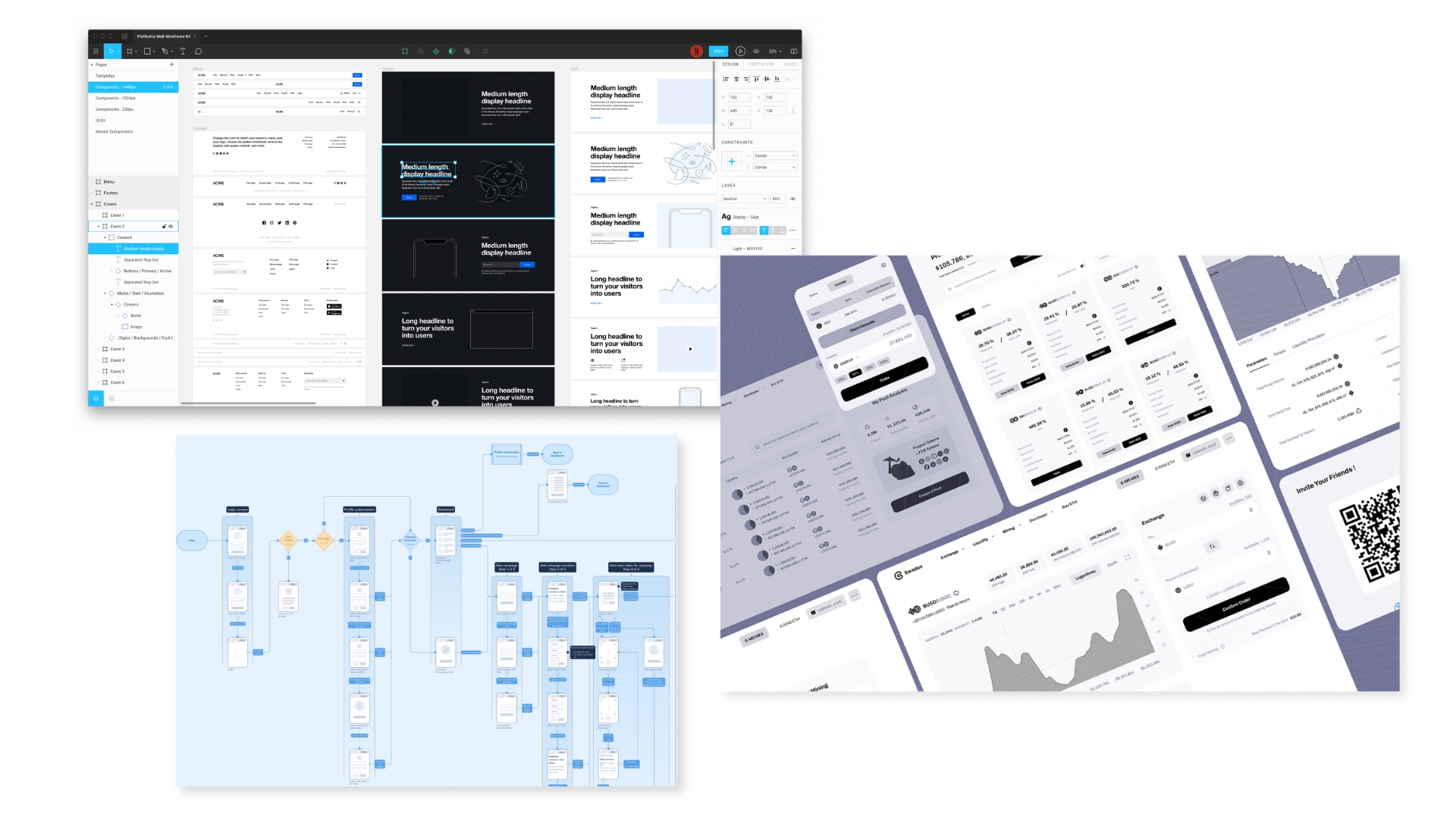

Design

- High fidelity mockup development

- Description of the developed functionality

- Description of the stack of technologies used

- Creation of a work implementation plan

- Calculation of the timing and cost of project production

Design

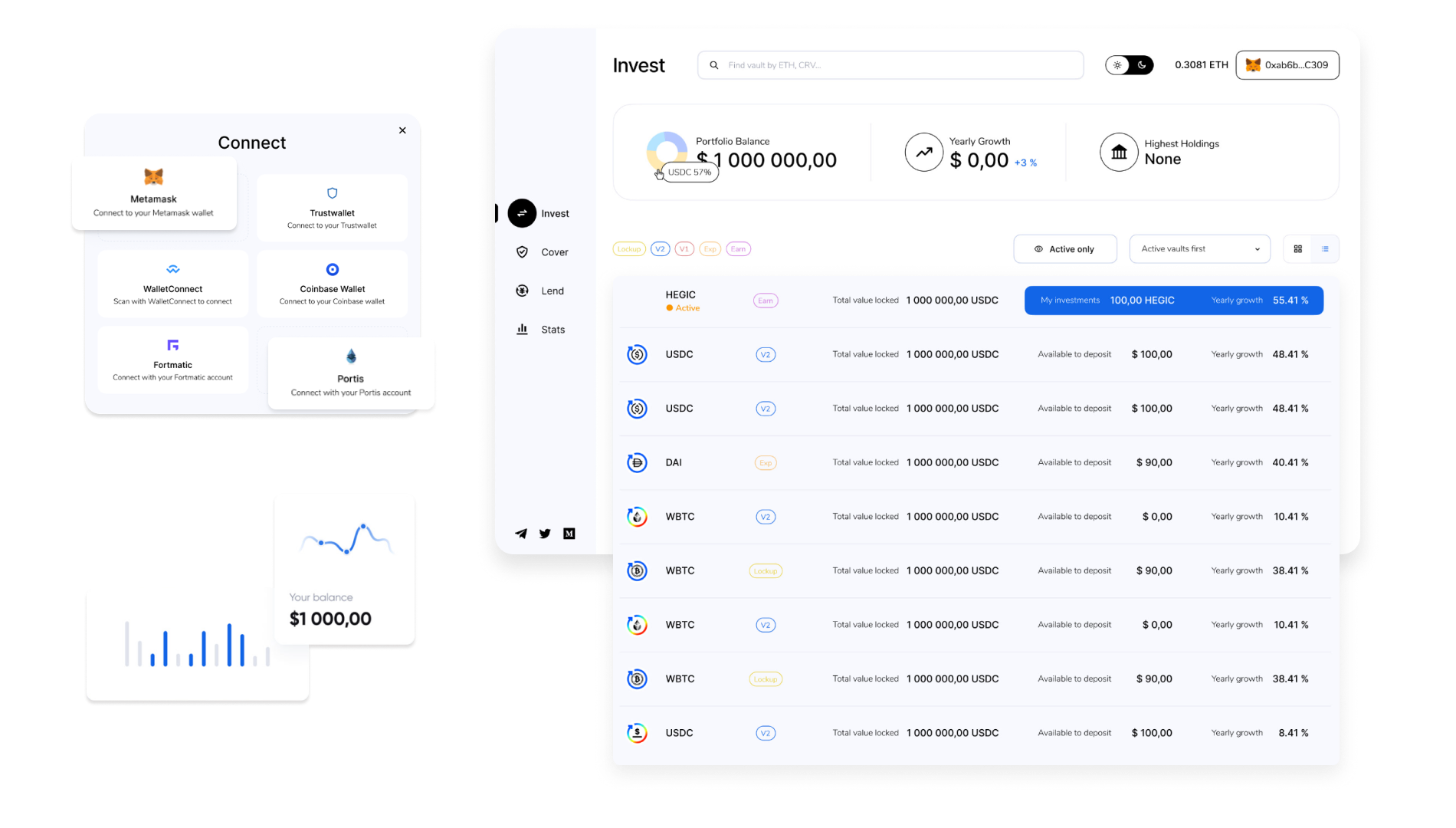

Our experienced team of UX/UI designers create an interface that will make it easier for the client to interact with DeFi and will allow you to unlock all the benefits of the aggregator.

Frontend development

The interface is created using React.js and Vue.js reactive technologies, and HTML and CSS can also be used to implement it.

React.js is an open source JavaScript library. React can be used as a foundation when developing single page, mobile or server applications using frameworks such as Next.js.

Vue.js is a JavaScript library for building web interfaces using the MVVM (Model-View-ViewModel) architecture pattern.

Backend development

In DeFi applications, most of the backend is built into smart contracts. Therefore, our team makes every effort to make them as reliable as possible.

At this stage, developers create and run all the necessary algorithms for your platform to work, as well as perform the necessary integrations with other DeFi protocols.

Testing

Since DeFi aggregators are all about money, it is necessary to check that everything works flawlessly and is guaranteed to be completely safe before accepting real users. At this stage, our team tests the project for errors and compliance with the TOR. After that, the product is ready to go to the market.

Improvements and development of the project

In order for the project to remain relevant among users, the team refines and improves it, expanding its capabilities and functionality. In addition to direct development, we are also ready to provide services for the promotion of a new tool.

Why is it worth turning to AVADA MEDIA when developing DEFI aggregators?

Why is it worth turning to AVADA MEDIA when developing DEFI aggregators?

At a time when our financial world is becoming decentralized, the desire for user-friendly applications is positioning aggregators as a crucial and important tool.

Our team consists of specialists with extensive experience in the development of DEFI aggregators. They are ready to provide the best technological solution for every project.

Fresh works

We create space projectsFresh works

The best confirmation of our qualifications and professionalism are the stories of the success of our clients and the differences in their business before and after working with us.

Our clients

What they say about usOur clients What they say about us

Successful projects are created only by the team

Our teamSuccessful projects

are created only by the team Our team

Contact the experts

Have a question?Contact the experts Have a question?

-

Phone:+ 38 (097) 036 29 32

-

E-mail:info@avada-media.com.ua