What is a Centralized Exchange (CEX) and how does it work?

Decentralized and centralized exchanges

BlockchainDecentralized and centralized exchanges Blockchain

With the introduction of blockchain, a technology that is considered decentralized in nature, a new model has emerged for companies that act as intermediaries between traders – cryptocurrency exchanges.

Since the advent of the crypto market, cryptocurrency exchanges have generally been centralized, meaning that all transactions must go through their systems and infrastructure.

However, today traders have to choose between using a centralized exchange (CEX) or a decentralized exchange (DEX), and in order to make informed decisions, you need to understand their differences, advantages and disadvantages.

In this article, we’ll cover everything you need to know about CEXs – centralized exchanges, including how they work and what you’ll face when building your own CEX.

What is a Centralized Exchange (CEX)

What is a Centralized Exchange (CEX)

A centralized cryptocurrency exchange is a platform through which parties can securely exchange digital assets. CEX exchanges provide an environment where buyers and sellers can transact quickly. They also act as liquidity providers for the tokens they support, taking on the role of market makers.

All transactions made on these exchanges are executed electronically and recorded on the respective blockchain that enables the exchange of specific digital assets.

CEXs carefully screen tokens and coins prior to listing and provide traders with a variety of pair options to exchange, as well as the statistics for each asset to make trading decisions.

By using blockchain, CEX crypto exchanges have eliminated the need for an intermediary broker. This is due to the fact that all transactions are carried out directly inside the exchange through its own interface. The largest and most trustworthy CEXs include: Coinbase, Kraken, FTX, KuCoin, Poloniex, Binance, Bitfinex, Gemini, Bittrex, CEX.IO, etc. The full, daily updated rating of CEX exchanges can be found on the Coinmarketcap and Coingecko portals.

How does a centralized exchange work?

How does a centralized exchange work?

Centralized exchanges that support digital assets receive orders from individual or institutional clients and match buy and sell orders with the same price. On the other hand, they can also act as market makers, providing liquidity to the tokens backed by their platforms in order to increase execution speed. Since CEXs manage all the data of placed orders, for an additional fee, they can also provide this information to market participants for analysis. In addition, they allow developers to list the tokens of their project, having previously verified such assets for compliance with their requirements.

To create orders in CEX, users do not need to contact a broker. Instead, their assets are stored in a wallet, from where they can be freely transferred to the exchange at any time.

A very important characteristic of centralized exchanges is regulation. Since these platforms deal with billions of dollars and serve millions of customers from different countries, they usually need to get permission to provide their services from local governments.

In addition, CEX exchanges must comply with a variety of laws and regulations, including Know Your Customer (KYC) protocols, Anti-Money Laundering (AML), and Countering the Financing of Terrorism (CFT) protocols. In addition, they are required to ensure that all transactions are carried out transparently and in accordance with certain procedures that do not allow market participants to distort the prices of assets.

Advantages and disadvantages of centralized exchanges

Advantages and disadvantages of centralized exchanges

Like any financial instrument, centralized crypto exchanges have their pros and cons that you need to know before you start using their services.

Advantages

- Protection from problems with the law.

The absence of any centralized authority makes transactions risky and even somewhat illegitimate. Since CEXs have a physical presence in the market and are regulated by the government, investors can avoid legal problems by using their services.

- Access for institutional clients.

There are quite a few institutional investors looking to invest in cryptocurrencies in order to diversify their holdings. But there is one caveat: the charters of such organizations require that they deal only with reputable financial institutions. For such investors, centralized exchanges are very important, as they provide a mechanism approved by the legislation of many countries for investing in cryptocurrency markets.

- Great service.

Centralized exchanges provide a very important service to cryptocurrency investors – 24/7 support. These exchanges have call centers whose staff is trained to explain all the nuances of cryptocurrency trading in an accessible and understandable language. Many centralized exchanges also provide custody services. This means that they have a specialized infrastructure for storing digital currency. Some of the exchanges also provide services in which digital coins are stored offline on special equipment. These opportunities are very valuable for investors who care about the safety of their investments.

- Insurance.

Despite multi-stage, high-tech protection, cryptocurrency exchanges are regularly attacked by scammers. It is for this reason that funds on a cryptocurrency exchange are usually insured. Of course, an additional fee is charged for the provision of such insurance. However, thanks to this, investors do not have to worry about the safety of their assets.

- Various tools.

Cryptocurrency centralized exchanges also provide additional services that may include various statistics, charts and analytics to help investors make decisions.

Flaws

- Limited number of cryptocurrencies.

On most centralized exchanges, only 40-50 types of cryptocurrencies are available for trading. This is only a small part of the total on the market. Since CEX exchanges care about their reputation, they only list verified assets, which reduces the number of trading options. Considering that most of the growth over the past few years has been in new cryptocurrencies, this approach limits investors from making a profit.

- Confidentiality.

Since CEXs are licensed by governments, they must follow strict government standards, with KYC regulations on some exchanges on par with those of large banks. In addition, centralized exchanges interact with a large number of regional and national authorities, which can access the data of exchange clients. These rules are an obstacle for investors who prefer privacy.

- Bankruptcy risk.

Centralized exchanges are private companies. Therefore, the money they have in their custody is actually a loan they have received from investors. However, where there is credit, there is always the possibility of default. Although such cases are very rare, and among the well-known exchanges there has not been a single case of bankruptcy yet, the risk of losing money still exists.

The reality is that centralized exchanges provide some legitimacy for digital currency trading. At the same time, they increase security for investors and protect them from many risks and unpredictability.

CEX Development

Technology and developmentCEX Development Technology and development

Centralized exchanges are a lot like banks – they provide storage, monitoring, security, customer support when needed, and in some cases, they can even provide investment advice. In order for all functionality to work correctly and, at the same time, remain scalable, it must be developed on stable and proven technologies.

The choice of a technology stack is often carried out by the development team, and depends on the platform on which the project is planned to work:

- Web application. Works in the browser and can function in different operating systems. The front-end part of such projects is implemented using static technologies — HTML, CSS, and JavaScript, or reactive ones, such as Vue.js or React.js. There are also options for implementing the backend part – it can be built in Python and its Django / Flask frameworks, in PHP and Yii2 / Laravel frameworks, or in Node.js – the JavaScript runtime.

- Desktop applications. They are installed on the user’s computer or laptop and work outside the browser. They can also be developed using the Python and PHP programming languages, as well as their frameworks — Django/Flask and Yii2/Laravel, respectively.

- Mobile applications. These are classic applications that are installed directly on the user’s smartphone. Here, the choice of technology also depends on the operating system: for IOS, the native Swift language is often used, and for Android, Java and Kotlin languages. At the same time, there are technologies that use the same codebase to run on both operating systems. For example, using the Flutter framework and the Dart programming language, you can create one application for IOS and Android, which will significantly reduce the investment required for development.

Stages of developing a centralized exchange

Stages of developingStages of developing a centralized exchange Stages of developing

From a technical point of view, a CEX exchange is a complex functional product consisting of many components. In order for it to function correctly, and in accordance with the customer’s plans, the development process is carried out in several stages. Let’s consider the main ones in a little more detail.

Stage 1. Gathering information

First of all, specialists need to determine the requirements of the client and the tasks that the exchange will perform. To do this, online or offline communications are conducted with the customer and all his wishes are recorded. In addition, specialists carry out marketing analysis of the market, which makes it possible to determine the competitive advantages of the project being developed, its positioning and advantages for potential users.

Stage 2. Design and technical documentation

At this stage, a full-fledged prototype of the exchange is created, which will become the basis for developers at all subsequent stages. In particular, specialists determine the technology stack that will be used in the production process, the project implementation plan and create mockups of the unique pages of the exchange, with a detailed description of the functionality that will be placed on them.

After the design is completed, the time it will take developers to implement CEX and the amount of investment required from the customer is calculated.

Stage 3. UI design

The design of a centralized exchange is no less important than its functional part. It makes interaction with CEX simple, understandable and logical, and also inspires confidence on the part of end-users – investors.

UI designers are involved in the development of external design for the project. They can implement the design from scratch – in this case, each element of the exchange: tables, icons, buttons, etc. – are drawn manually. However, this approach takes a lot of time and, accordingly, is more expensive for the customer. Therefore, designers, most often, resort to using ready-made templates and toolkits, and adapt them to the business tasks of the future exchange.

Stage 4. Programming

When the design is ready, the developers start programming the technical part of the CEX exchange. This process can be divided into two main stages:

- Frontend development. Includes the creation of a user interface, in accordance with previously approved design layouts. In fact, at this stage, the “picture” created by the designer is transformed into code that is understandable for the browser or the desired operating system. The tasks of the frontend include receiving requests from users and transferring them to the server for further processing. However, if the frontend is implemented on the reactive Vue.js or React.js technologies that we wrote about above, it can also perform partial data processing before sending it to the server, which improves the performance of the exchange and the response speed for the client.

- Backend development. This is the part of the project that is located on a remote server and is responsible for the correct operation of the functionality, calculations and integration with third-party services, databases and cryptocurrency wallets.

Stage 5. Testing

After the technical development is completed, the CEX exchange undergoes thorough testing in the QA department. This allows you to identify most of the errors even before real traders are involved in the project.

There are several types of testing:

- modular;

- integration;

- functional;

- acceptance.

If errors are found in the functionality of the QA-engineers, they make a bug report and return the project for revision to the responsible employees. After the issue is fixed, the exchange is tested again to make sure that the bugs have indeed been fixed and that the changes made do not affect the operation of other functions.

Stage 6. Support and development

During the first time after the project has been deployed and started to be used in real conditions, users may encounter hidden errors that were not discovered during the testing phase. Therefore, after the release of the exchange, the technical work on the project does not end. When such situations arise, developers test the system, determine the cause of the problem, and then fix it as part of technical support.

Also an important stage in the process of technical support of the exchange is its subsequent development. As a rule, in the first months after the launch of the CEX, it becomes clear what functionality is missing in it, as well as what operations can be improved to increase efficiency. To implement such upgrades, developers release patches with updates, which are later simply installed on the current system, without stopping its operation.

Development of a CEX exchange in AVADA MEDIA

Development of a CEX exchange in AVADA MEDIA

Centralized cryptocurrency exchanges act as intermediaries between buyers and sellers of digital assets, and guarantee the transparency, security and legitimacy of all transactions. Since the work of CEX is controlled by external regulators, only verified cryptocurrencies and tokens are listed in their listing, which is a trigger for attracting new users, for whom, first of all, reliability and stability are important.

Today, CEXs cover a much larger market share compared

to decentralized exchanges – DEXs, so investing in creating your own platform is more likely to be profitable and bring income.

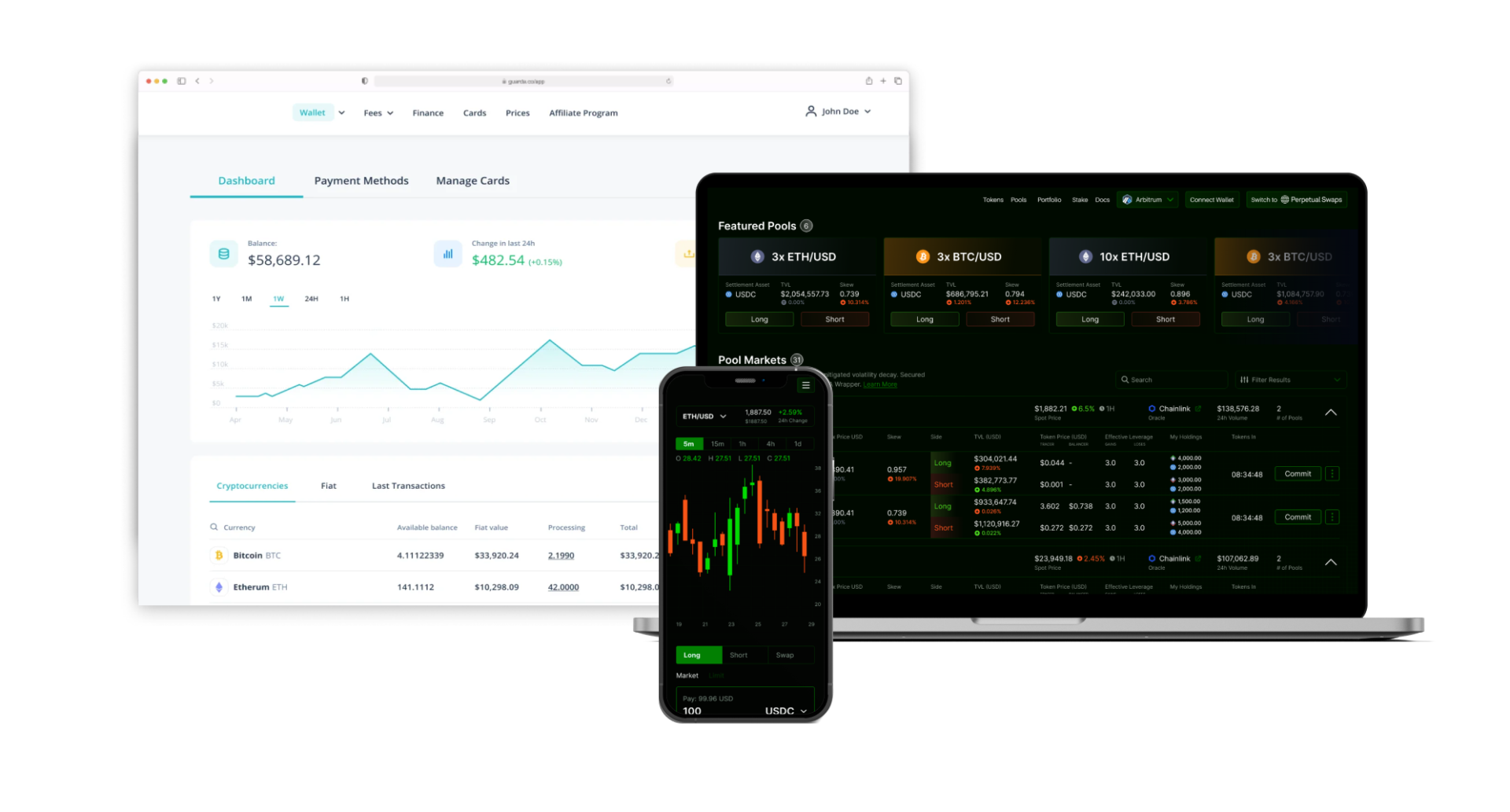

AVADA MEDIA has practical experience in implementing blockchain projects of varying complexity, including cryptocurrency exchanges and exchangers. In the work on such projects, we involve already formed teams of specialists with well-established communication, so you can be sure of the quality of the final result.

Fresh works

We create space projectsFresh works

The best confirmation of our qualifications and professionalism are the stories of the success of our clients and the differences in their business before and after working with us.

Our clients

What they say about usOur clients What they say about us

Successful projects are created only by the team

Our teamSuccessful projects

are created only by the team Our team

Contact the experts

Have a question?Contact the experts Have a question?

-

Phone:+ 38 (097) 036 29 32

-

E-mail:info@avada-media.com.ua