You can order from our company the development of a mobile application for any industries and company. More recently, for successful sales on the Internet, it was enough to have your own website. But today, everything has changed. Modern technologies are making adjustments to business via the Internet. More and more companies are ordering the development of mobile applications, realizing that a simple site or online store is no longer enough.Why is custom application development so popular? Having the application, the company can more effectively interact with both customers and its employees. The program will provide all the necessary options and functions that contribute to the most convenient management of the enterprise and employees.

Using a mobile application, you can issue orders and monitor their implementation, exchange documents and keep abreast of everything that happens.In addition, the development of a mobile application for your company will significantly increase the efficiency of working with clients. Now you will always be with them, via a program installed on your smartphone. This will inform customers about promotions, sales, and special offers, without using all the boring mailing. Plus, to order goods and services, seek advice or ask a representative of the company, the client will also be able to use the application interface.

Your company decided to order the development of the application? We will create exactly what you need! Before our team gets to work, we will find out what exactly you want to receive from the mobile application. To do this, answer a number of simple questions.

Having many years of experience in programming mobile applications, we can confidently say that the last point is the most important. If installing the product on the client’s smartphone does not give him any advantages, he will most likely not use it. Even if the application gets a beautiful design and user-friendly interface.

We know exactly how to make the application, the development of which was entrusted to us in such a way that it interested the user and was useful to him. The solution to this issue depends on which segment your company operates in.To make it clearer, here are a few examples. So, if ordering a mobile application is performed for a sports club, it must necessarily contain information useful to the user. It’s a training schedule, a coach’s work schedule, and the hall’s work schedule. A recording option is required via the application interface. Users will also appreciate the availability of additional information about the proper implementation of exercises, recommendations for sports nutrition, diets, etc.If you need to order an application for the bank, then mobile development will provide for the user to work with their accounts. It is necessary to provide for the functionality of money transfers, currency exchange, searching for the nearest branch and ATM, working hours, etc. If you order the development of an application for catering, then in its functionality it is necessary to provide for the study of the menu, the possibility of booking a table online, a chat window with the administrator, etc.

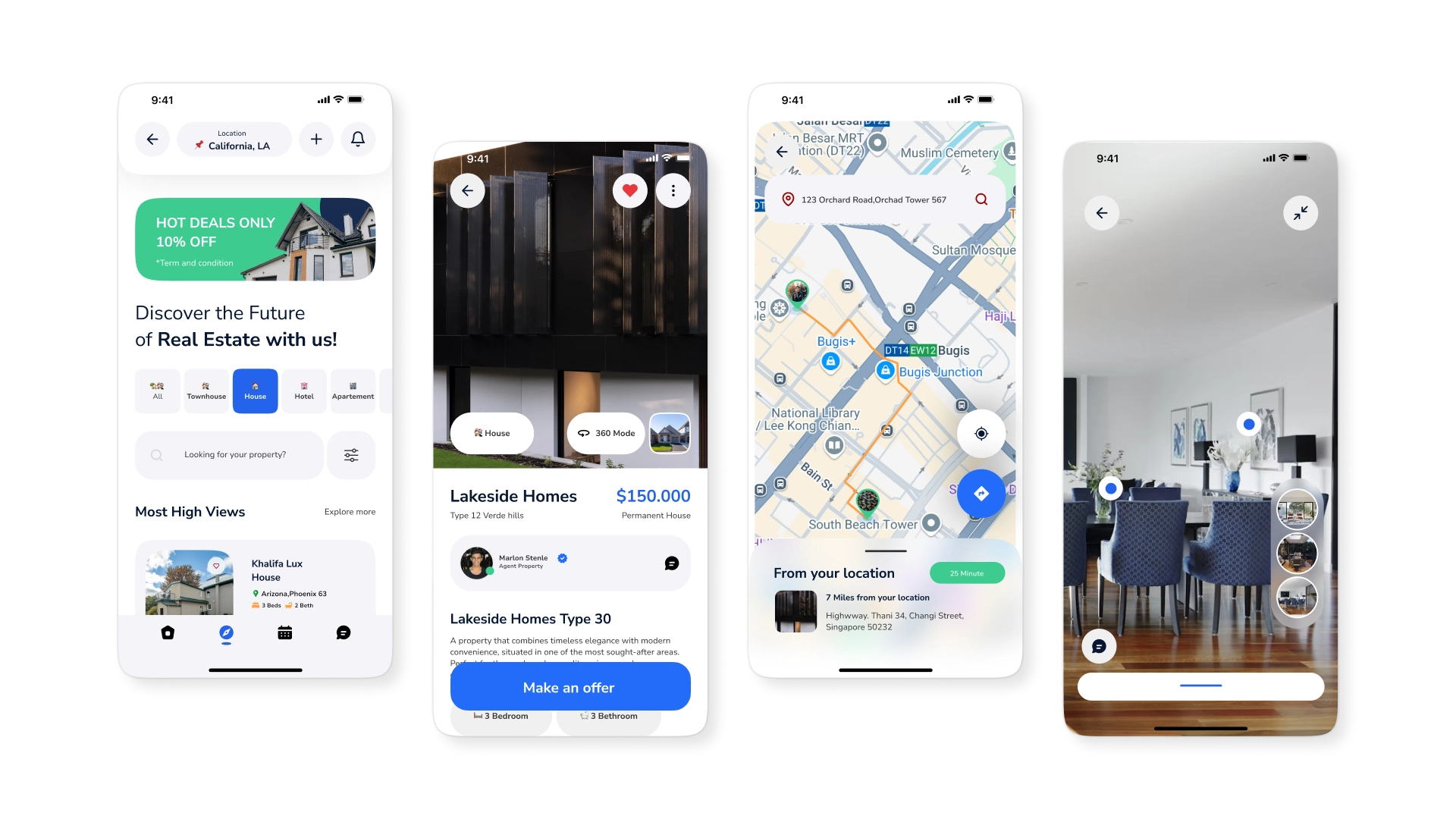

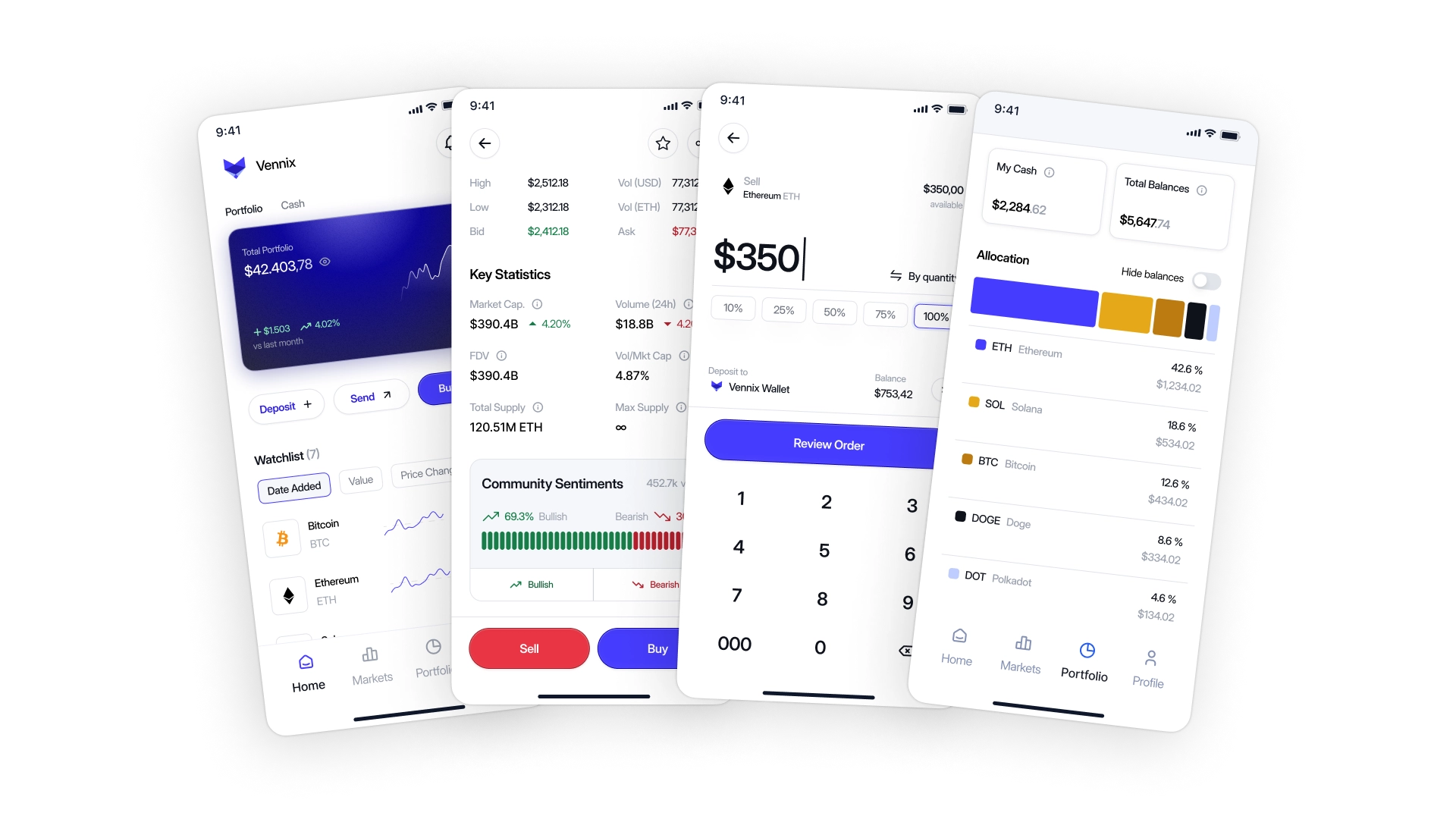

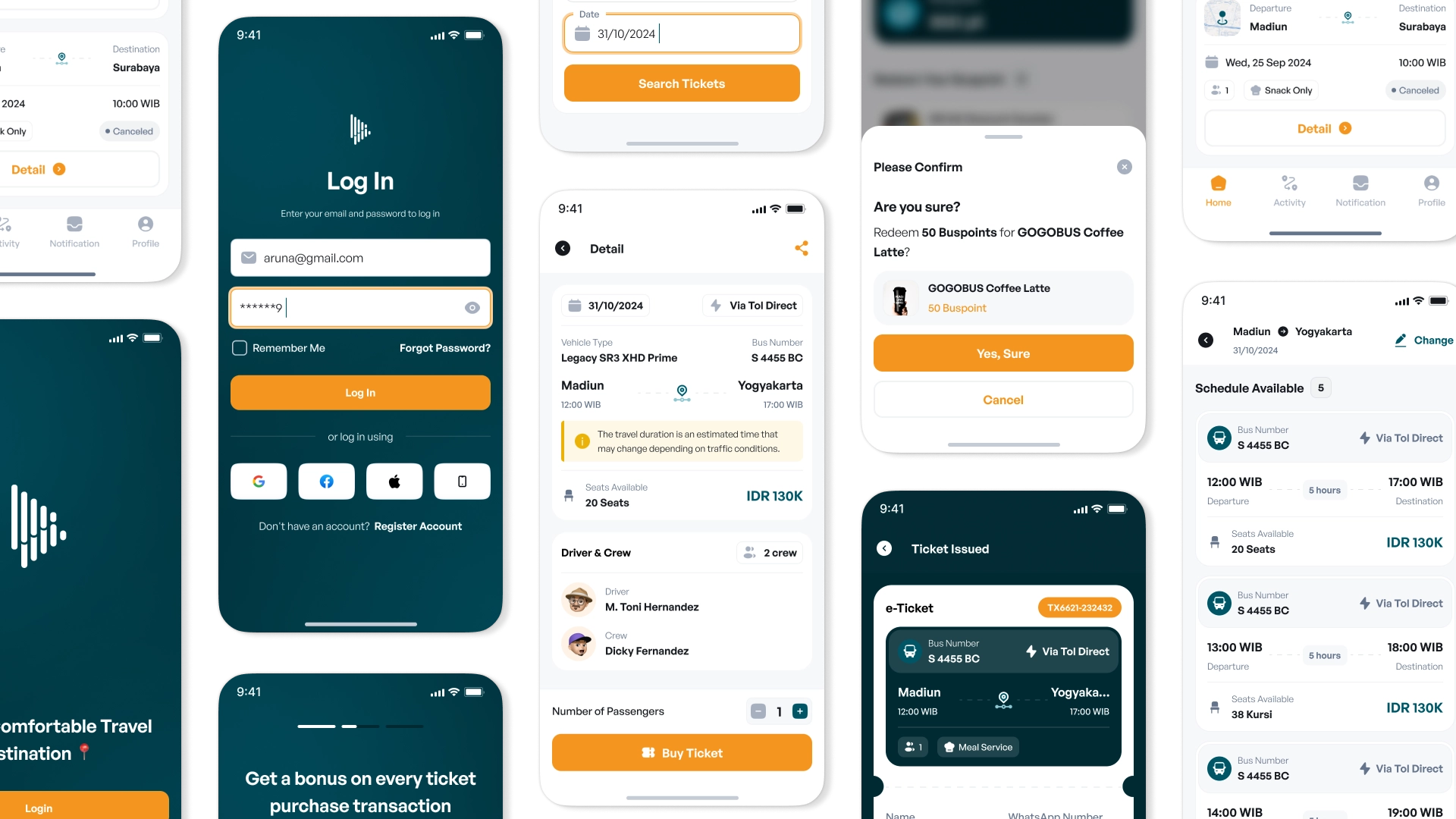

Examples of mobile applications

All mobile applications developed by our company are user-oriented. First of all, we think about what the one who will install and use the product needs. The success of developing applications for mobile devices is based on the needs of the client and user.

This is the first and most important step that you need to take to create a successful mobile app.The development of mobile applications, which you can order from us, will lead to a high-quality successful product. Your application is sure to be appreciated by users. In addition to development, our QA engineers will help in testing an already finished mobile application for the order.The AVADA-MEDIA team creates mobile applications for IOS, ANDROID, as well as CROSSPLATFORM applications for business and entertainment.

Our experts analyze the market segment and the needs of the target audience. We evaluate the available advantages of the proposed product and the needs of the customer. All further work of the company on the development of mobile applications is carried out only after immersion in the client’s business

We plan every step and every action of the entire development team. This allows us to ensure that the development of mobile applications to order by our company is carried out on time and within budget.

We pay special attention to the analysis of the market and the characteristics of the customer’s business. We study the needs of the target audience, and application development is carried out taking into account all the features and needs of the customer’s company.

At the design stage, a separate paragraph is carried out work on the application interface. We do everything so that screens, menus, and user interface control buttons are easy to use.

In addition to the user interface, application development for smartphones includes the creation of the server side. This part of the software ensures the stable operation of the application.

By ordering custom applications in our company, you get a quality product. Convenient intuitive user interface with the necessary set of options and functionality.

At the testing stage, the product is tested for operability, the absence of failures and critical errors. Identified deficiencies are eliminated, adjustments are made in accordance with the wishes of the customer.

After the creation of the application for the phone is completed, our specialists will train the staff of your company to work with the product. Your employees will be able to independently process incoming applications and work with the server side of the application.

Creating applications for mobile phones is not only about writing code and launching a product. In the process of work, constant technical support, the release of new versions, etc. are required. These services are also provided by our company.

Our works

Contact the experts Have a question?

The user, filling out an application on the website https://avada-media.ua/ (hereinafter referred to as the Site), agrees to the terms of this Consent for the processing of personal data (hereinafter referred to as the Consent) in accordance with the Law of Ukraine “On the collection of personal data”. Acceptance of the offer of the Consent is the sending of an application from the Site or an order from the Operator by telephone of the Site.

The user gives his consent to the processing of his personal data with the following conditions:

1. This Consent is given to the processing of personal data both without and using automation tools.

2. Consent applies to the following information: name, phone, email.

3. Consent to the processing of personal data is given in order to provide the User with an answer to the application, further conclude and fulfill obligations under the contracts, provide customer support, inform about services that, in the opinion of the Operator, may be of interest to the User, conduct surveys and market research.

4. The User grants the Operator the right to carry out the following actions (operations) with personal data: collection, recording, systematization, accumulation, storage, clarification (updating, changing), use, depersonalization, blocking, deletion and destruction, transfer to third parties, with the consent of the subject of personal data and compliance with measures to protect personal data from unauthorized access.

5. Personal data is processed by the Operator until all necessary procedures are completed. Also, processing can be stopped at the request of the User by e-mail: info@avada-media.com.ua

6. The User confirms that by giving Consent, he acts freely, by his will and in his interest.

7. This Consent is valid indefinitely until the termination of the processing of personal data for the reasons specified in clause 5 of this document.

Send CV

Contact us in any convenient way for you:

+ 38 (097) 036 29 32