The word blockchain is associated with cryptocurrencies for most of the population. It’s because the fully replicated distributed database, which is the basis of blockchain technology, was first implemented in the Bitcoin system. To date, in addition to Bitcoin, there are many other cryptocurrencies. Besides, blockchain technologies have begun to be implemented in other software solutions for business.

Most often, the development of blockchain projects is still applied in the field of operations with finance, cybersecurity technologies, and for identifying users. However the technology’s capabilities are not limited to these areas and there are opportunities to develop blockchain applications and programs in other business sectors.

Databases organized by blockchain technology are continuous sequential chains of blocks that contain information. Blocks are not only numbered but are also connected by so-called hash sums, which is the result of processing data with a special function. Each block of the chain contains two hash sums, its own and the previous block of the chain. To change the information contained in a single block, you will need to change the data in all subsequent blocks of the circuit. Technically, this is extremely difficult. That’s what increases the reliability of databases organized by blockchain technology to unprecedented heights.

Information blocks are usually scattered across many computers located around the world. This contributes to the even greater complexity of making changes to the data circuit, and further increases the reliability of data storage. Transactions in the blockchain are made as follows:

This scheme provides blockchain technology with many advantages over the most common databases now.

Companies introduce the latest technologies to get benefits from their use. The blockchain provides such benefits. These include:

Transparency and reliability of the information storage system. Blockchain chains, in the vast majority of cases, are open source. This allows developers and users to modify them, which makes work easier. At the same time, it is almost impossible to make such changes unnoticed – for this, it is necessary to control more than 50% of the computing power of the network. It’s almost impossible.

Lower transaction costs. Blockchain works without intermediaries and there is no need to pay for their services. In the traditional settlement scheme, the intermediary, most often, is a bank that charges fees for transactions.

Speed up calculations. Banks and other intermediaries work according to their schedule for a certain number of hours per day. They don’t work on weekends and holiday. The speed at which people perform duties is limited by physiology. As a result, a transaction conducted through an intermediary takes several days. Blockchain works 24 hours a day, 365 days a year.

Decentralization of data entry and storage systems. When using blockchain technology, there is no need to create a data collection and processing center. Individual transactions have their own confirmations and authorization to communicate with their participants. The fact that the total amount of system data is scattered across a multitude of servers located around the world increases their security against hacking. Even if one of the servers is hacked, only a small part of the general information will be compromised.

The ability to control the network by its users. To make changes to the database organized by blockchain technology, users and developers must come to a consensus. Change without such consensus is not possible. So, since the consensus of 80% of users was not reached, the most famous cryptocurrency split into Bitcoin and Bitcoin Cash.

The advantages of using blockchain technology in networks with low levels of trust between users are particularly obvious. In the same Bitcoin system, transactions are carried out by millions of users scattered around the world and personally unknown to each other. We are not talking about trust, and there is no intermediary guaranteeing the deal. If you are not sure whether you really need blockchain technology, ask the developer. Traditional databases, in some cases, work better.

The cost of developing a specific project or application using blockchain technology depends on the wishes of the customer and the scale of the tasks. Due to the high data security, blockchain technologies are widely implemented in the public administration of different countries, as part of the fight against bureaucracy. France plans to invest 700 million euros in such developments and reduce 120 thousand officials.

Australia in 2018 invested 1 billion Australian dollars in similar projects, the European Union – 300 million euros. The exact cost of the project for your business can only be calculated after drawing up a detailed technical specification (TOR). Due to the fact that the development of technical specifications is expensive and takes a lot of time, in some cases, it makes sense to set this idea aside it and focus on the tariff rates of specialists, with hourly pay for their work.

Avada Media has been operating in the software development and implementation market for over 9 years and has completed hundreds of projects for customers from the USA, Australia, the EU and CIS countries, Russia, and Ukraine. We are ready to offer developments in the field of:

This is not a complete list of the company’s capabilities in the blockchain development. Contact Avada Media, and all your wishes for the software will be realized.

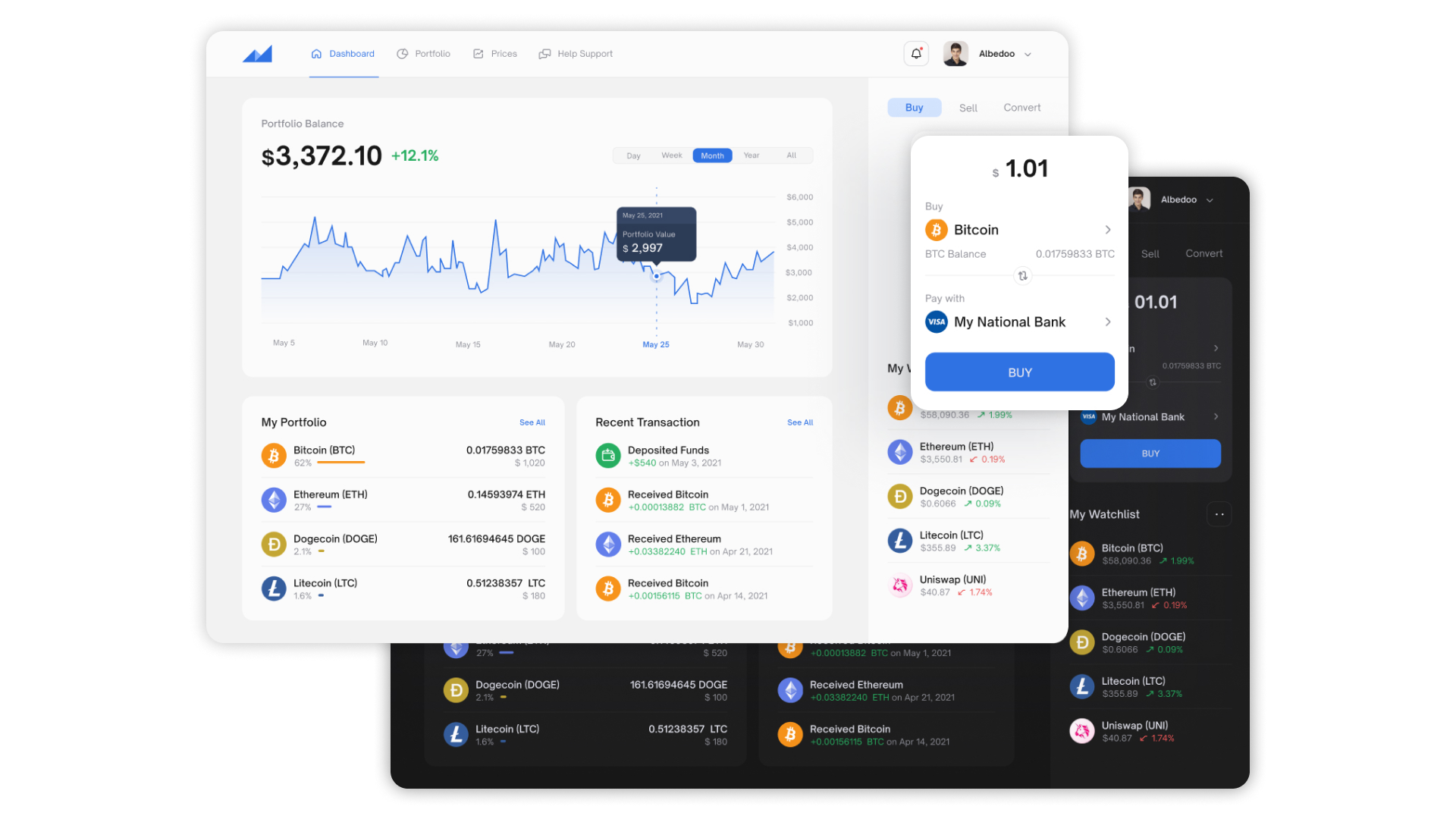

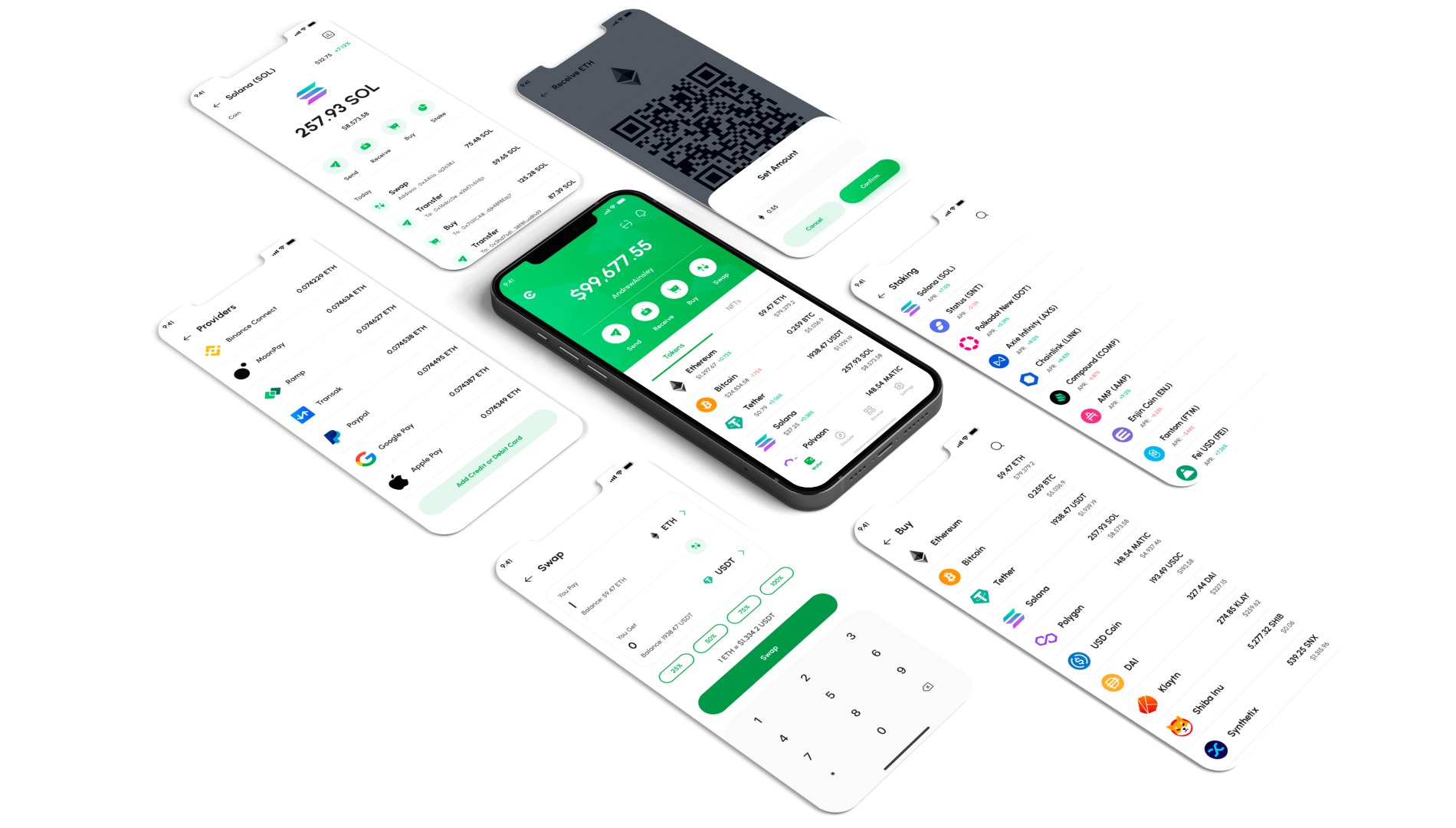

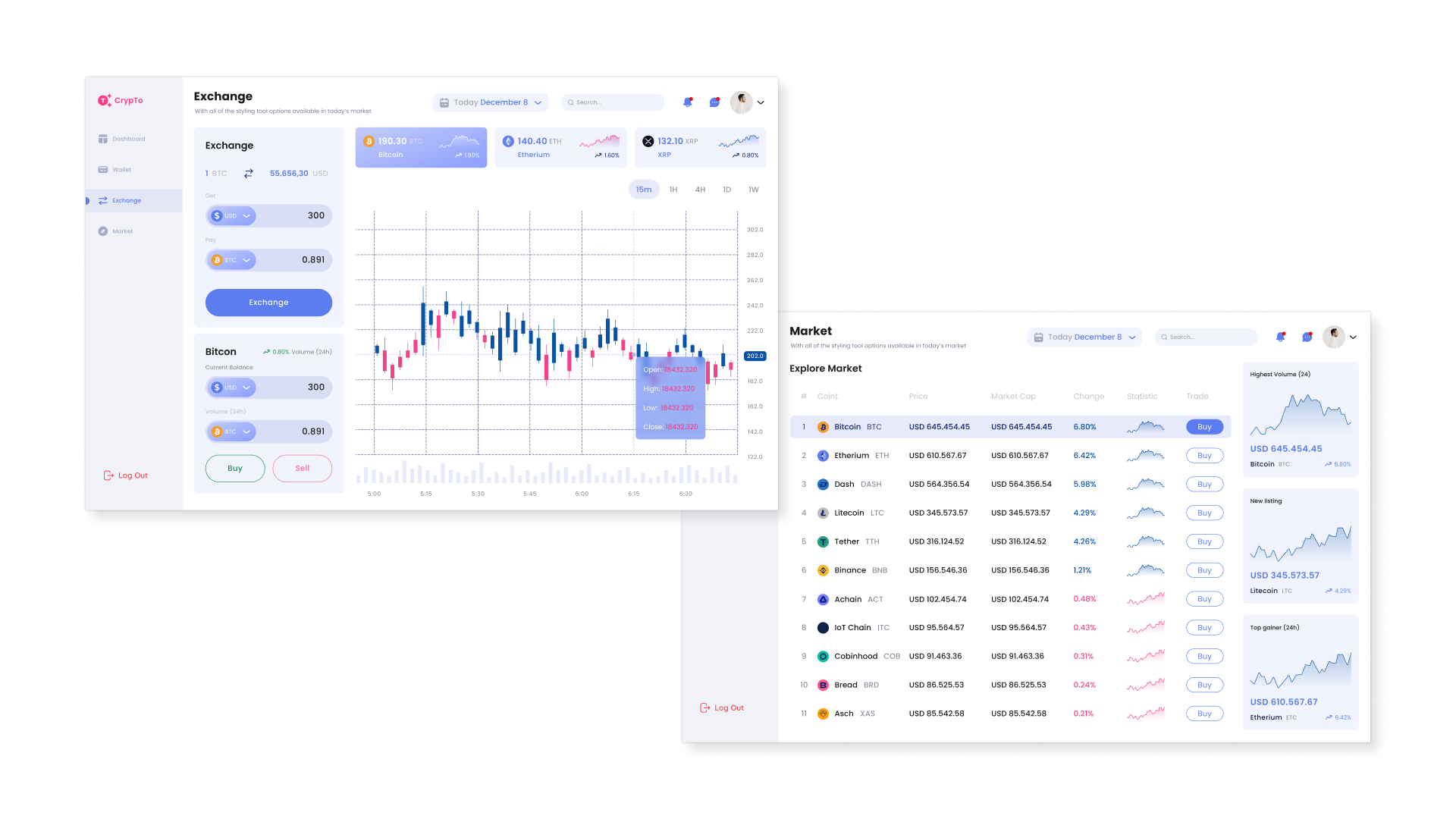

Our works

Contact the experts Have a question?

The user, filling out an application on the website https://avada-media.ua/ (hereinafter referred to as the Site), agrees to the terms of this Consent for the processing of personal data (hereinafter referred to as the Consent) in accordance with the Law of Ukraine “On the collection of personal data”. Acceptance of the offer of the Consent is the sending of an application from the Site or an order from the Operator by telephone of the Site.

The user gives his consent to the processing of his personal data with the following conditions:

1. This Consent is given to the processing of personal data both without and using automation tools.

2. Consent applies to the following information: name, phone, email.

3. Consent to the processing of personal data is given in order to provide the User with an answer to the application, further conclude and fulfill obligations under the contracts, provide customer support, inform about services that, in the opinion of the Operator, may be of interest to the User, conduct surveys and market research.

4. The User grants the Operator the right to carry out the following actions (operations) with personal data: collection, recording, systematization, accumulation, storage, clarification (updating, changing), use, depersonalization, blocking, deletion and destruction, transfer to third parties, with the consent of the subject of personal data and compliance with measures to protect personal data from unauthorized access.

5. Personal data is processed by the Operator until all necessary procedures are completed. Also, processing can be stopped at the request of the User by e-mail: info@avada-media.com.ua

6. The User confirms that by giving Consent, he acts freely, by his will and in his interest.

7. This Consent is valid indefinitely until the termination of the processing of personal data for the reasons specified in clause 5 of this document.

Send CV

Contact us in any convenient way for you:

+ 38 (097) 036 29 32