The modern insurance business is a constant balance between customer trust, speed of service and legal accuracy. Insurance agents process large amounts of data, policies and applications on a daily basis, and customers are becoming more and more demanding of service. To remain competitive, companies must fine-tune the processes of interaction with customers, quickly adapt to market changes, but it is difficult to do this without digitalization. Automation of the work of an insurance company is not only about accuracy and convenience, but also about a strategic advantage.

If you want to implement a powerful tool that optimizes the key processes of your business, ensures the transparency of all operations, reduces the burden on employees and improves service, you need to order the development of CRM for an insurance company from AVADA MEDIA. Our specialists create management systems from scratch and adapt ready-made solutions to the individual needs of the business. With us, you can focus on the main thing – your customers, and increase profits.

CRM is a program for automating insurance agencies, which helps to properly organize their work: simplifies the management of the client base, maintains document flow and reduces the time for processing applications. This is a comprehensive tool that allows you not only to manage insurance products, but also to improve the quality of customer service, anticipate their needs and quickly respond to requests.

A CRM system for an insurance company opens up a number of opportunities for agents and managers. Thanks to automation, there are more satisfied customers, and profits are growing. Let’s consider what functions an online platform for insurance agents can take.

Customer Base Management

A CRM system for an insurance company stores the history of requests, tracks the stages of interaction, and generates personalized offers. With such a program, you can manage all aspects of customer interaction: from the first contact to the renewal of the contract.

Document workflow automation

Generation and sending of contracts, policies, settlements, acts – with a high-quality custom CRM, insurance will take place in a few clicks. Instead of you, the system can keep records of policies, insured events and payments, monitor the terms of contracts.

Sales control

The program for insurance agents helps to track sales funnels, analyze the effectiveness of marketing activities, evaluate results, predict customer needs based on data and offer them optimal insurance solutions.

Effective team management

CRM for insurance companies gives managers full control over the work of agents, their tasks and results. They can monitor the workload of employees, effectively distribute and plan tasks, and assess the productivity of the team.

Auto-renewal of insurance policies

Timely renewal of contracts is the key to a stable income for the insurance company. CRM can automatically remind the client of the need for renewal, offer updated conditions, and even generate contracts online. This minimizes customer loss, increases customer retention, and makes the customer journey as easy as possible.

Unified contact database

CRM for an insurance agent provides centralized storage and systematization of information about customers, partners and counterparties, providing quick access to information. Customer segmentation, automatic sending of notifications and reminders do not allow customers to be missed.

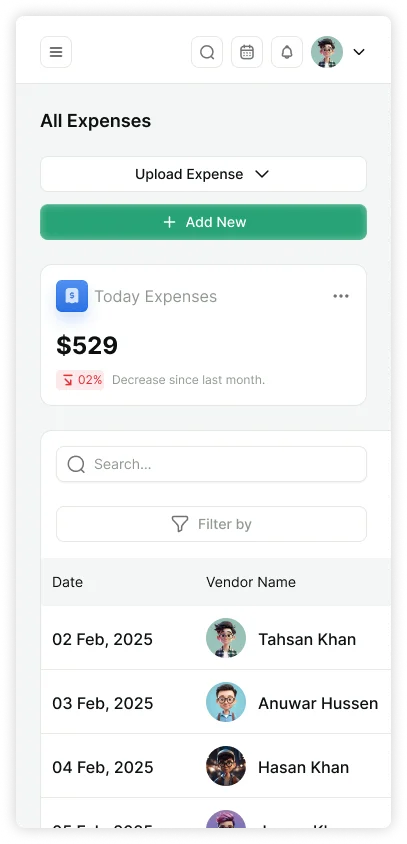

Reporting

Automatic generation of reports on sales, customers, insured events and other indicators frees up time and minimizes the likelihood of errors. Your own management system provides access to detailed reports on your agency’s work, helps you identify trends and make informed decisions.

Mobility

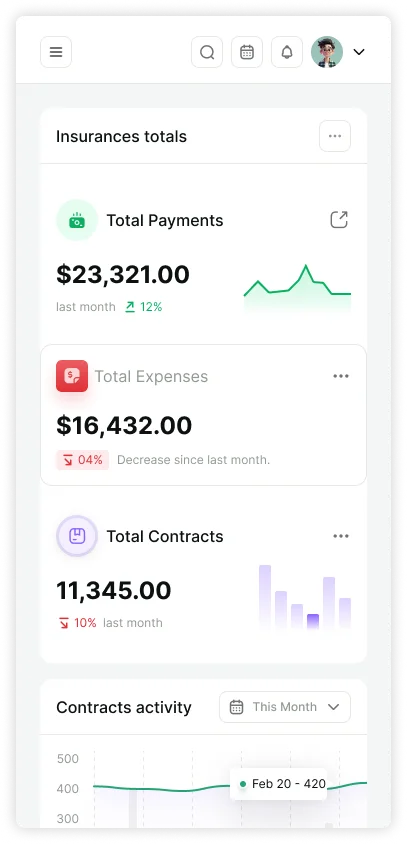

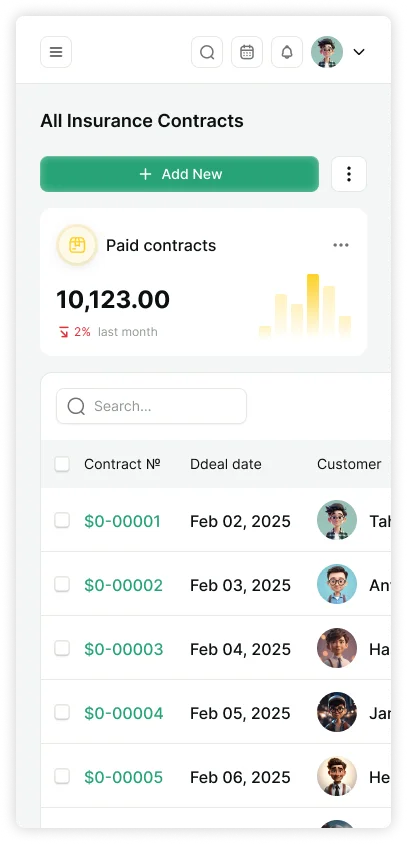

Insurance agents often have to work outside the office – in meetings with clients, on-site visits, and on the go. This requires constant access to the data. The mobile version of CRM allows employees to always have information about policies, requests, customers, and insurance events at hand. They can respond quickly to requests and be in touch anytime, anywhere.

A smart approach to insurance

AI integration into a CRM system automates routine tasks and opens access to in-depth analytics. Artificial intelligence algorithms predict customer behavior, identify fraud attempts, and suggest relevant insurance products based on previous interactions. For example, the system can automatically offer the client an extension of the policy or cross-insurance without the participation of a manager.

Flexible configuration of access rights

CRM allows you to configure access levels in detail: one can edit, another can only view, and the third can work with certain data blocks. This increases the security and transparency of internal processes.

Advanced Data Protection

We take a comprehensive approach to ensuring data protection in CRM. All data stored in the program and transferred between its components is securely encrypted using modern cryptographic algorithms. And two-factor authentication protects against unauthorized access.

Personalized approach

CRM saves the history of requests, insurance events, customer preferences, so that each agent can provide a better and more personalized service. Customers feel attention, care, become more loyal to your insurance company and see no reason to go to your competitors.

Scalability without limits

Individual development of a CRM system allows you to easily scale your business: connect new departments, add users, and open new insurance areas. Thanks to the modular architecture, it is possible to implement additional functions without global changes to the program.

Integration with other systems

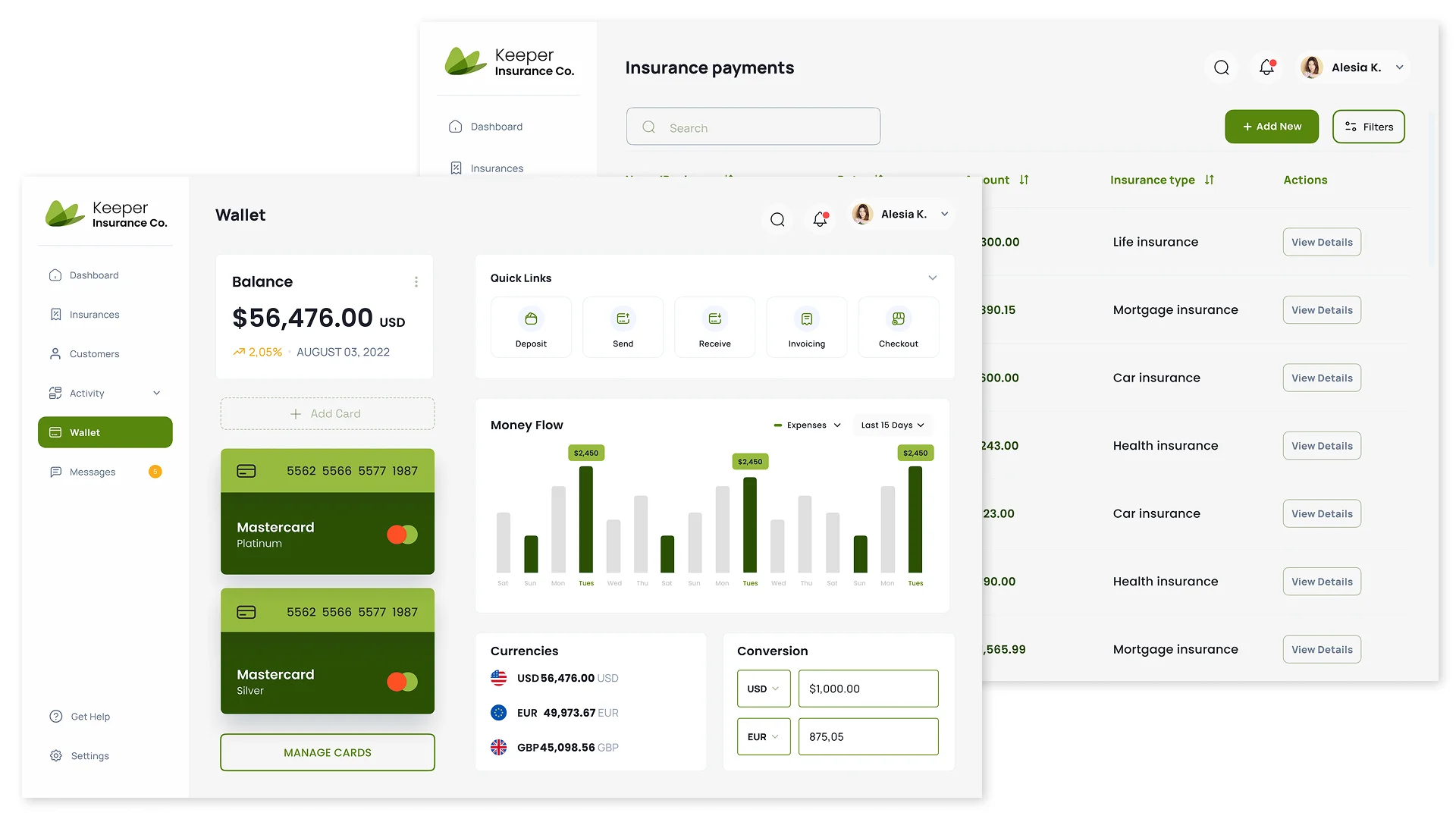

With an individual CRM system, insurance companies can create seamless integrations with the website, mail, telephony, online payment, and banking services.

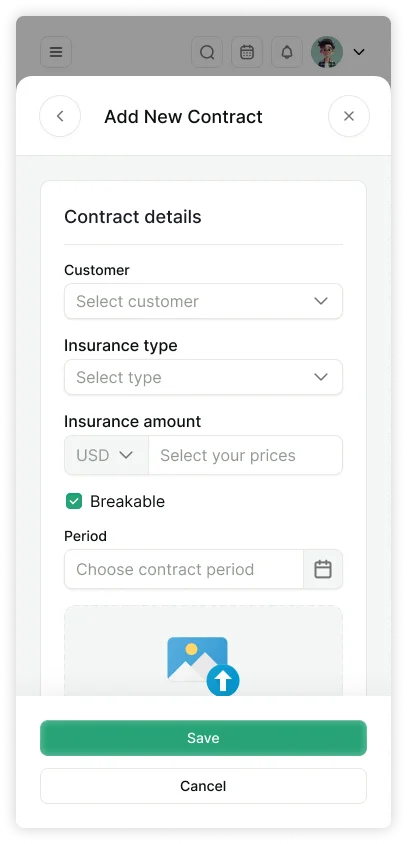

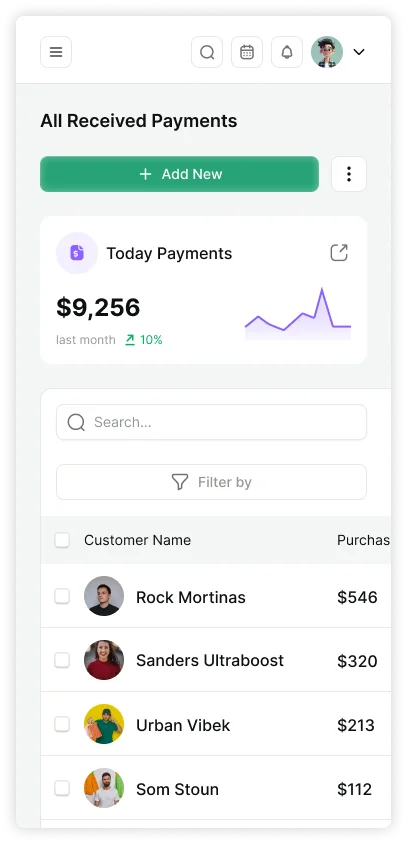

Mobile version of the insurance company's CRM system

Insurance automation becomes a critical necessity when routine tasks are time-consuming, applications are processed late, and important information is lost due to disparate communication channels.

If you miss customers due to delays, drown in paperwork, use several different programs, and can’t quickly find the information you need, then it’s high time for you to order the development of CRM for insurance agents. When a company strives for growth and development, but cannot effectively manage the flow of data and processes, this program will combine everything in one place and make work easier and more efficient.

Individual development of a CRM system for the insurance business can include both a basic set of functions and advanced modules – more complex mechanisms of analytics, automation and partnership. It is up to you to decide what kind of structure your company needs at this stage.

Basic CRM modules include:

Advanced modules that can be implemented as your business grows:

Such a modular approach allows you to gradually implement a CRM system, gradually adding functions for the specific tasks of an insurance company – from retail insurance to corporate contracts and managing a partner network of insurance brokers.

CRM for an insurance company will become your intelligent assistant, accurately assessing the potential of each client. By receiving data from internal and external sources, it allows policymakers to predict the profitability of each customer and make informed decisions about customer retention, pricing, and service priorities.

The assessment of the client’s profitability in the management system is formed taking into account several factors:

So, the system can assign an individual rating of profitability or reliability to the client, which is then used in automatic triggers. By segmenting potential buyers by a comprehensive assessment or individual indicators, you can personalize interaction with them – offer special conditions, discounts, inform about new products and extensions of current policies.

CRM integration capabilities for an insurance company largely depend on the type of insurance services provided. The flexibility of a custom CRM allows you to adapt the system to the specific tasks of each insurance product.

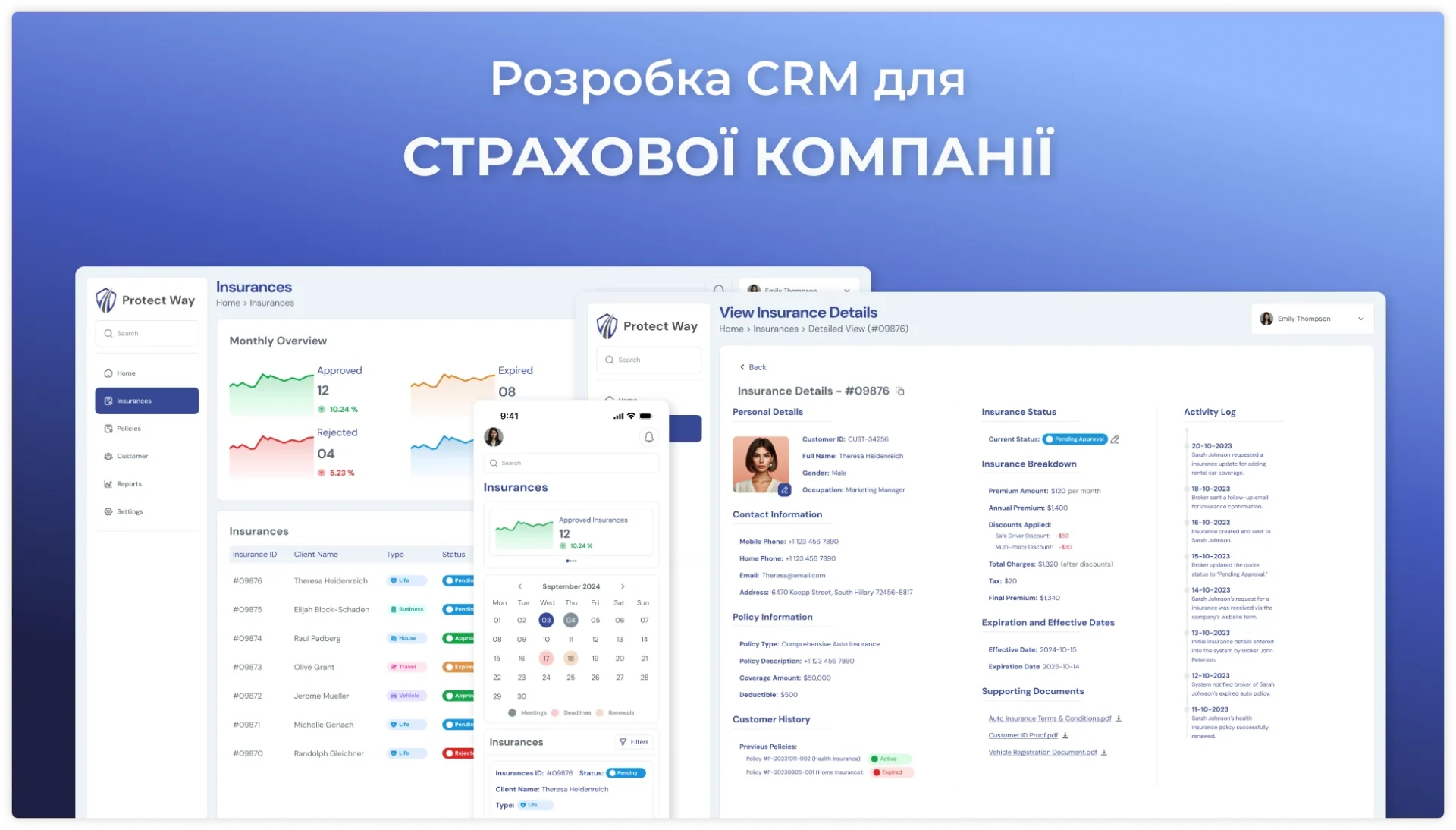

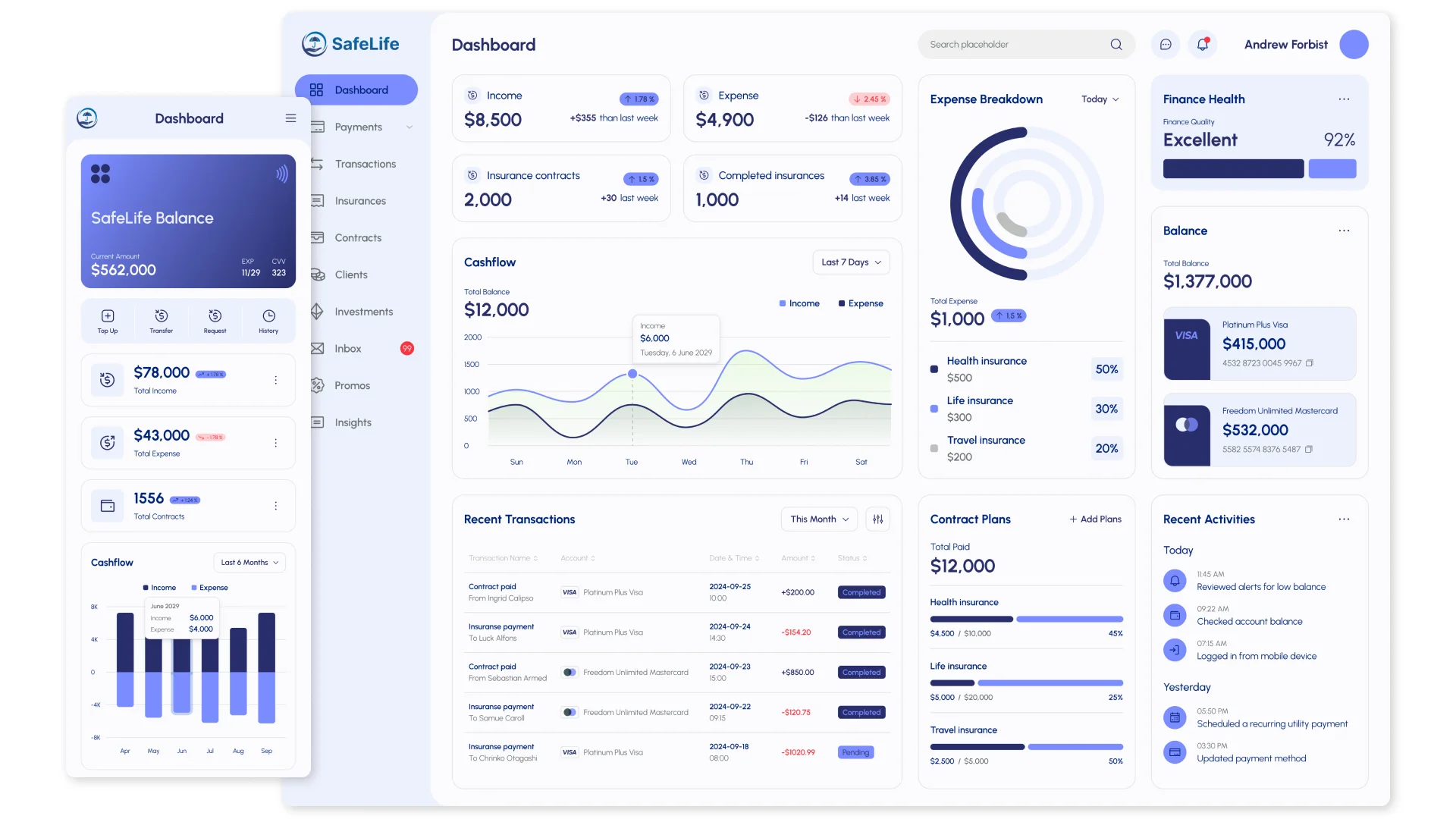

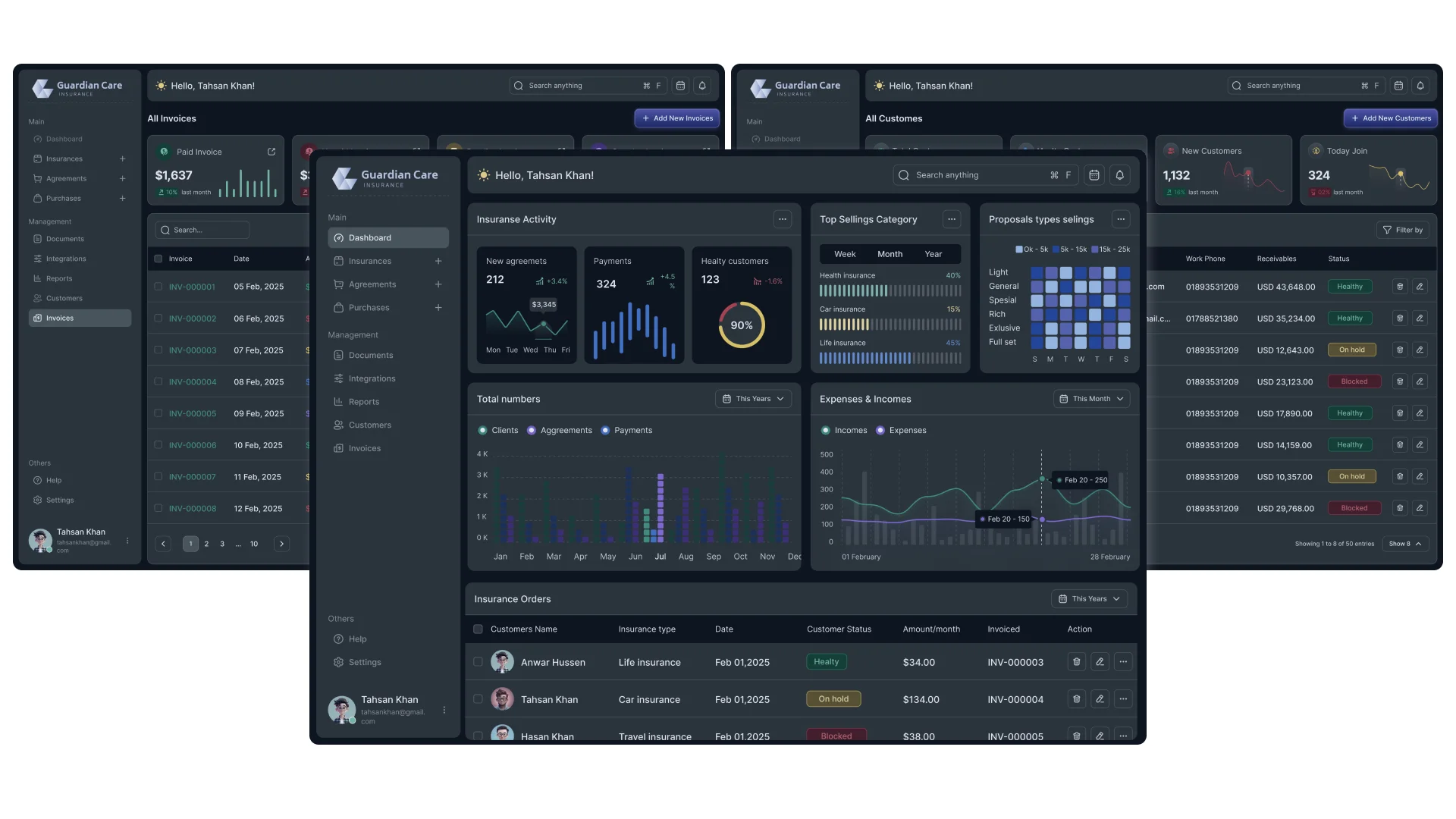

CRM example for an insurance company

CRM development for an insurance agency is a multi-stage sequential process in which each decision affects the result. Let’s consider the main stages of creating a system.

At the first stage of development, a detailed analysis of the needs of the insurance company, current business processes, problem points and expectations from the system is carried out. It is important to take into account the specifics of the insurance business: a large amount of documentation, the need for integration with external services – electronic signatures and banking systems, as well as increased requirements for data security.

Based on the analysis, a technical specification is developed that describes the requirements for the system. It outlines the key functions of CRM: customer base management, workflow automation, integration with third-party systems, reporting, as well as performance and security requirements. The technical specification serves as the basis for further stages of development and guarantees that the system will meet all the customer’s criteria.

Design and prototyping is the stage of visualizing the structure and functionality of the future system using interactive mock-ups. Prototypes of the main screens allow you to see and test the convenience and functionality of the program, make adjustments before the start of development.

UX/UI design development is the creation of a visual shell of the system. It is important that the interface is equally understandable for all users. The design should include elements that simplify the work with the customer base: creating policies, processing applications, and maintaining reports. Visualization of the process of applying for and obtaining an insurance policy should be as clear as possible, with clear instructions and a minimum number of steps. Insurance agents often work outside the office, traveling to the sites of insured events and meetings with clients, so the CRM design should be adaptive so that the program can be used on any device. The design should correspond to the corporate identity of the company, look modern, harmonious and original.

Using programming languages and technologies, libraries, and frameworks, programmers write code for the frontend, which is the interface that the user interacts with, and the backend, which is the backend that processes requests and manages data. Also, at this stage, databases are integrated that store information about customers, policies, insured events and payments. The task of the developers is to ensure the high speed of the CRM system and data protection, since insurance companies work with personal information.

This is a mandatory stage where QA testers check the performance of all program functions, performance, security, and the correct operation of integrations. The user-friendliness of the interface and its compliance with user requirements are also evaluated. The purpose of this stage is to identify and fix errors before the program is put into operation.

This stage includes installing CRM on the company’s server, setting up all integrations with external systems, and training employees. It is important that the system is implemented with minimal delays in operation, and the transition process is gradual. Detailed instructions and trainings are created for users so that they can quickly start working with the new system.

This stage includes solving user problems and questions, updating the system, adding new features, mobile applications for agents or integrations with new external services, and optimizing the program. Regular security updates prevent data breaches and ensure compliance with new legal requirements.

Automation of the work of an insurance company is not just a tribute to digital transformation, but a necessity to increase efficiency and competitiveness. CRM for an insurance company is a tool that makes interaction with customers accurate, prompt and personalized, and the work of insurance agents is as productive as possible.

AVADA MEDIA is your reliable provider of services for the individual development of CRM for insurance agents and their comprehensive support after implementation. We know how important accuracy, security and speed are in the insurance industry, and we can offer a solution that fully meets the current requirements of your business. Our CRM systems automate processes, increase agent productivity, and improve customer service. Ordering CRM development from scratch from us means investing in a powerful and flexible tool that will provide you with a sustainable competitive advantage in the insurance market.

How long does it take to develop a CRM system for an insurance company?

The timing depends on the functionality and complexity of integrations. On average, a basic version of a CRM can be developed in 3-6 months, and a fully customized solution with advanced features can take 6 months or more.

Can CPM be integrated with banking and payment services?

Yes, CRM can be integrated with online payment systems, banks, and insurance brokers for easy automation of payments, settlements, and document signing. This is especially important in the insurance industry, where the speed of transactions affects customer loyalty.

How does CRM help automate the processing of applications and calculations?

The system automatically checks the data, calculates the cost of policies, checks for debts and sends invoices to customers. It also tracks the status of each ticket, notifying agents and customers of important changes.

How to protect customer data in the management system?

For the insurance business, the confidentiality of information is always a priority. Modern security methods: data encryption, two-factor authentication, role-based access control, automatic backups and protection against unauthorized access.

What reports can I generate CPM?

The system allows you to generate reports on sales, application conversion, agent efficiency, policy renewals, insured events, and payouts. You can also make predictions based on the data you collect.

How does the system help predict the demand for insurance products?

The system analyzes customer behavior, purchase history, and external factors (e.g., seasonality) and, based on this data, predicts the demand for various types of insurance, offering customers relevant services.

Is it possible to adapt CRM for different types of insurance?

Yes, CRM can be set up for any type of insurance: auto insurance, medical, travel, corporate, mortgage, and others. The flexible structure allows you to add unique fields, calculation algorithms, and document templates.

How much does it cost to develop a CRM system for an insurance company and what does the price depend on?

The price of such software depends on the set of functions, the complexity of integrations, the amount of customization and additional services (mobile applications, analytics, artificial intelligence).

How does CRM help speed up the payment of insurance claims?

The program automates the process of checking insured claims, simplifies work with documents, notifies customers about the status of payments and sends requests to banking systems. This reduces the timing of payments and increases customer confidence.

How does the management system reduce the number of errors in the execution of documents?

Automated data entry, information validation, and the use of templates help minimize errors. The system can also be integrated with databases for automatic loading of information.

Is it possible to connect a chatbot or a voice assistant?

Yes, CRM can be integrated with chatbots and voice assistants to help customers get policy information, submit claims, calculate insurance costs, and even initiate paperwork.

Why is CRM for custom insurance companies better than ready-made solutions?

Ready-made CRM systems usually have basic or universal functionality, so they require significant improvements and additional investments. Custom products are fully tailored to the specifics of your insurance business – from complex calculations of insurance premiums to automation of actuarial models, integration with internal databases, registers and specific APIs (for example, MTIBU, NBU). Individual CRM development eliminates overpayment for unnecessary modules and licenses, fully complies with security and legal requirements and ensures full ownership of the system.

Our works

Contact the experts Have a question?

Developed by AVADA-MEDIA™

The user, filling out an application on the website https://avada-media.ua/ (hereinafter referred to as the Site), agrees to the terms of this Consent for the processing of personal data (hereinafter referred to as the Consent) in accordance with the Law of Ukraine “On the collection of personal data”. Acceptance of the offer of the Consent is the sending of an application from the Site or an order from the Operator by telephone of the Site.

The user gives his consent to the processing of his personal data with the following conditions:

1. This Consent is given to the processing of personal data both without and using automation tools.

2. Consent applies to the following information: name, phone, email.

3. Consent to the processing of personal data is given in order to provide the User with an answer to the application, further conclude and fulfill obligations under the contracts, provide customer support, inform about services that, in the opinion of the Operator, may be of interest to the User, conduct surveys and market research.

4. The User grants the Operator the right to carry out the following actions (operations) with personal data: collection, recording, systematization, accumulation, storage, clarification (updating, changing), use, depersonalization, blocking, deletion and destruction, transfer to third parties, with the consent of the subject of personal data and compliance with measures to protect personal data from unauthorized access.

5. Personal data is processed by the Operator until all necessary procedures are completed. Also, processing can be stopped at the request of the User by e-mail: info@avada-media.com.ua

6. The User confirms that by giving Consent, he acts freely, by his will and in his interest.

7. This Consent is valid indefinitely until the termination of the processing of personal data for the reasons specified in clause 5 of this document.

Send CV

Contact us in any convenient way for you:

+ 38 (097) 036 29 32