The business related to microloans always works at high speed: while one repays the debt, another extends the loan, and the third delays the payment. Everything must be under control here, because a successful microfinance company is not the one that issues the most loans, but the one that knows how to effectively manage data, build long-term relationships with clients and minimize risks.

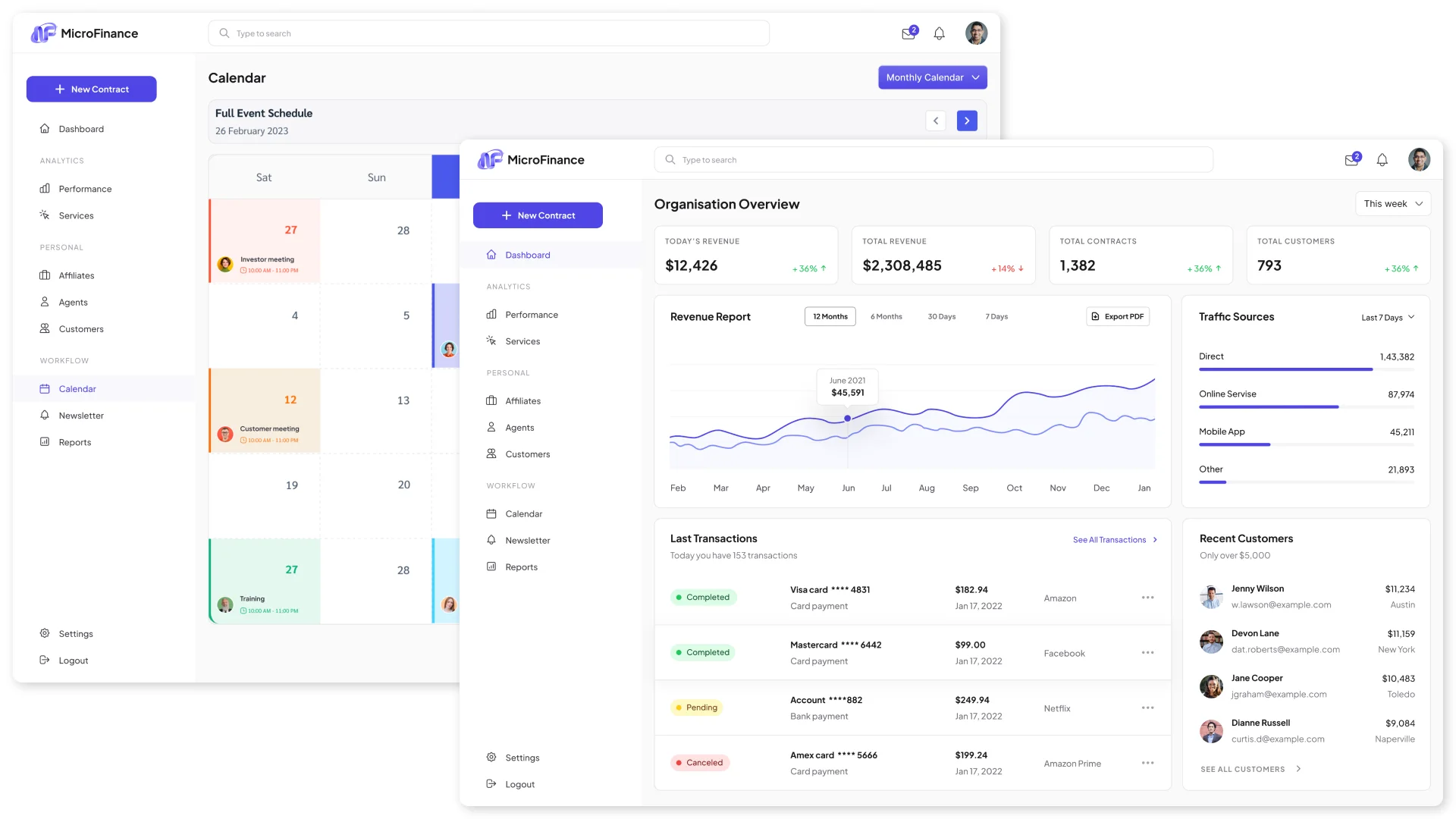

CRM for microfinance organizations is a key tool that combines all processes into a single, manageable and transparent system. This digital ecosystem helps to make quick and informed decisions, automate routine and increase customer loyalty.

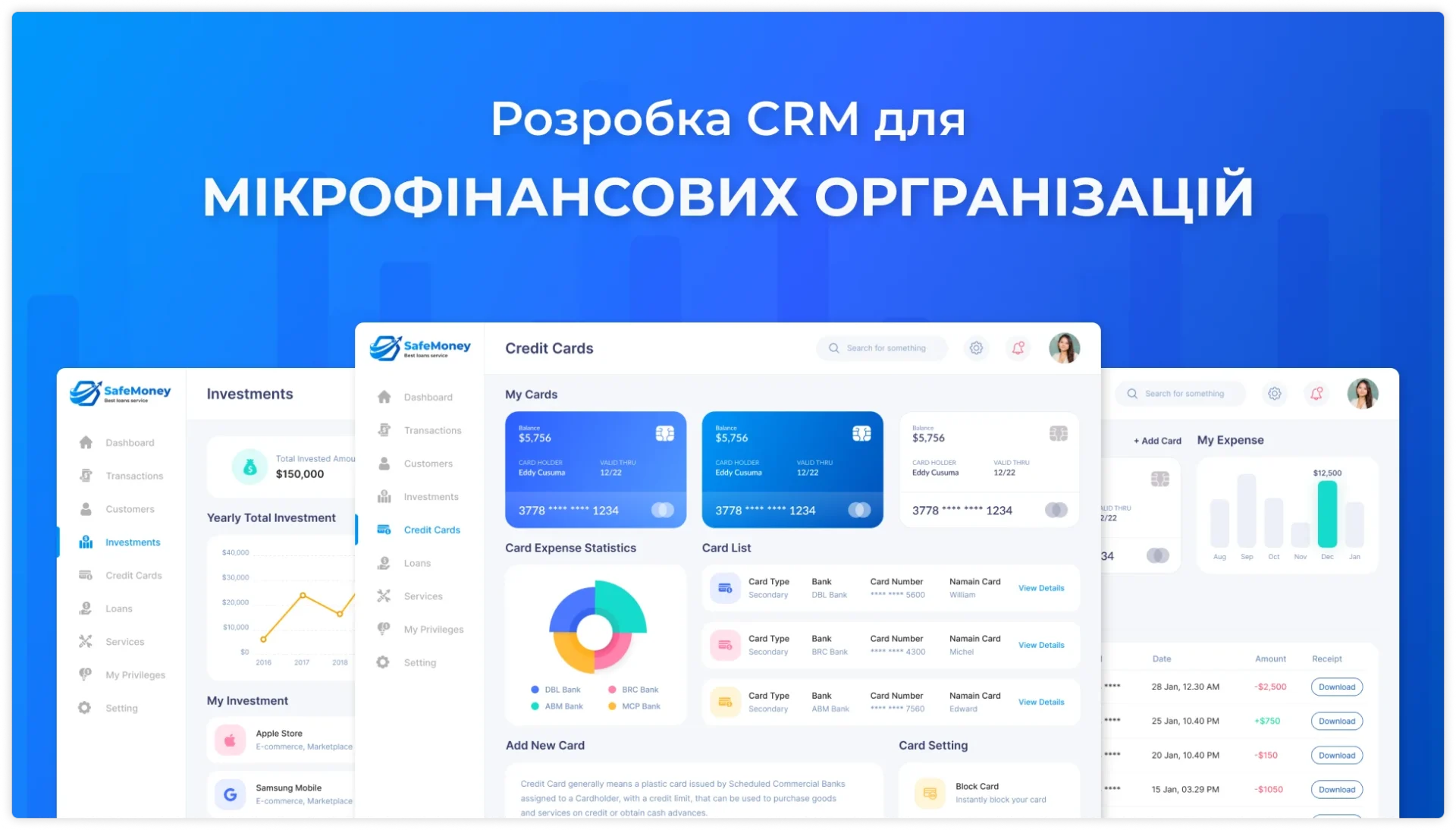

AVADA MEDIA offers CRM system development services for microfinance organizations. Thanks to its own program, you will manage your business not through endless calls, tables and manual reconciliations, but with a smart system that automates routine tasks and allows you to manage data.

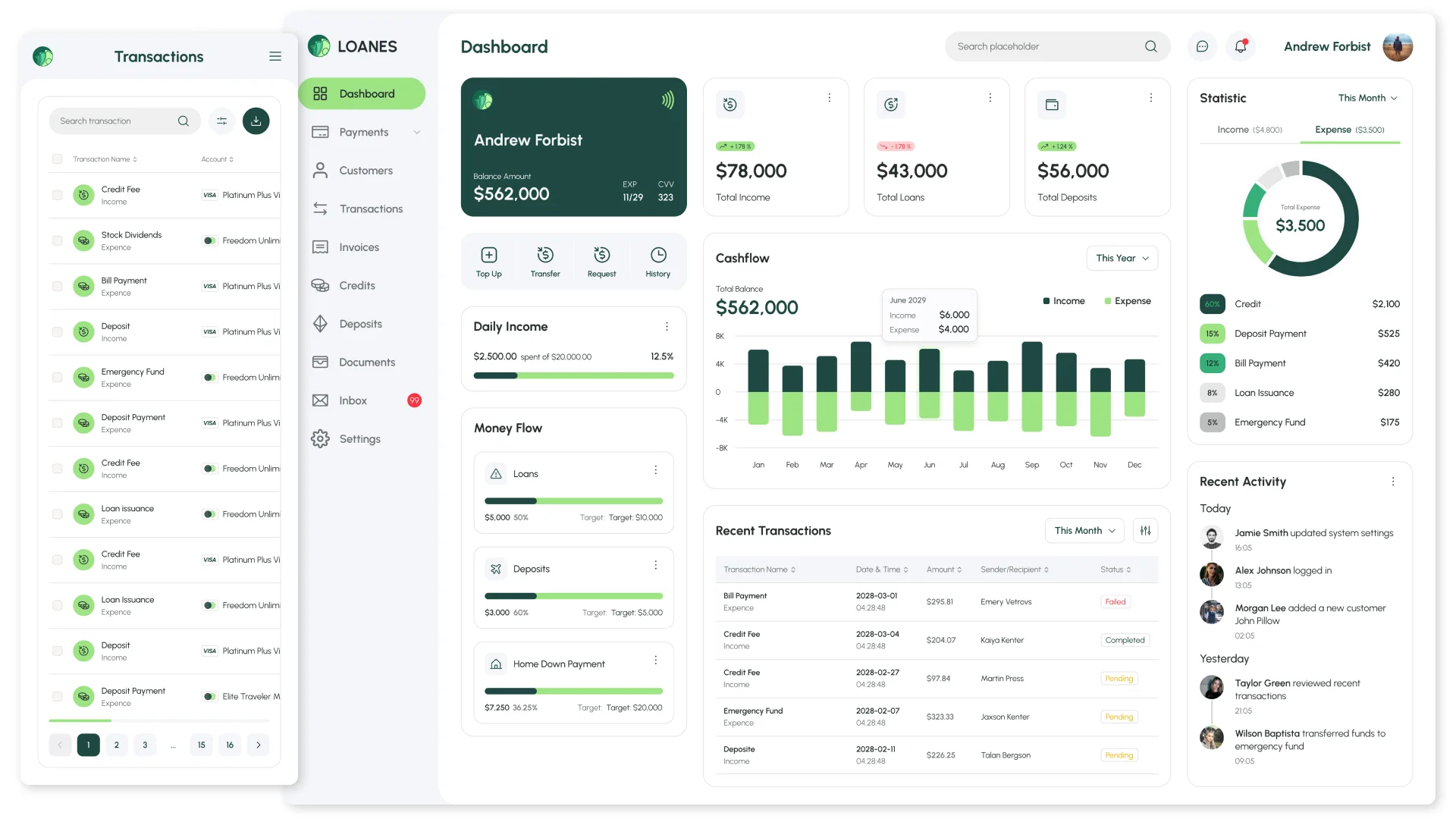

CRM for a microfinance organization is a customer relationship management system adapted to the tasks and processes of microlending firms, pawnshops, and credit bureaus. This program covers all processes: from the first contact with the client to the full repayment of the loan or transfer of the case to collectors. It collects and analyzes data, helps automate checks, generates reports, manages marketing campaigns, and even supports integration with external services – for example, state registries, credit history systems, and payment gateways.

Unlike universal CRMs, individually developed solutions take into account the specifics of the microlending industry: from borrower scoring and solvency assessment to automatic control of payment schedules, interaction with collectors, and compliance with regulatory requirements.

Managing microfinance institutions requires maximum flexibility and transparency, a balance between application processing speed and risk management. Such organizations regularly face problems that a custom CRM for MFIs can solve.

High workload on staff

Manual processing of applications, calls, payments, contract extensions takes a lot of time, effort, and attention. A microfinance organization management program helps to relieve employees by automating applications, reminders, and notifications.

Insufficient control over processes

Without a unified system, data is scattered across departments. A CRM system for MFIs combines all information in a single interface, providing management with a complete picture of the state of the business.

Risk management

Assessing the solvency of clients is a critical stage in the work of microfinance organizations. CRM integration with external databases (credit bureaus, state registers, scoring systems) allows for faster and more accurate decisions on granting loans.

Compliance with regulatory requirements

Microcredit organizations are required to store and process personal data of clients in accordance with the law, submit reports on time, and record financial transactions. CRM for MFIs simplifies the implementation of these tasks thanks to built-in regulations and templates.

High customer turnover

Competition in the microloan market is growing rapidly, and customer retention is a separate task. Tools for automatic SMS and email mailings, accrual of bonuses for repeated loans can be implemented in an individual program.

Quick decision-making

When a client urgently needs money, even an extra 15 minutes of waiting can cost you the deal. CRM system for microfinance organizations eliminates delays by processing applications automatically, distributing tasks between managers, issuing reminders and notifications, and updating history.

The program for MFIs allows you to remove the human factor from routine tasks, speed up application processing, and reduce operating costs. It synchronizes the work of all departments – from customer service to security.

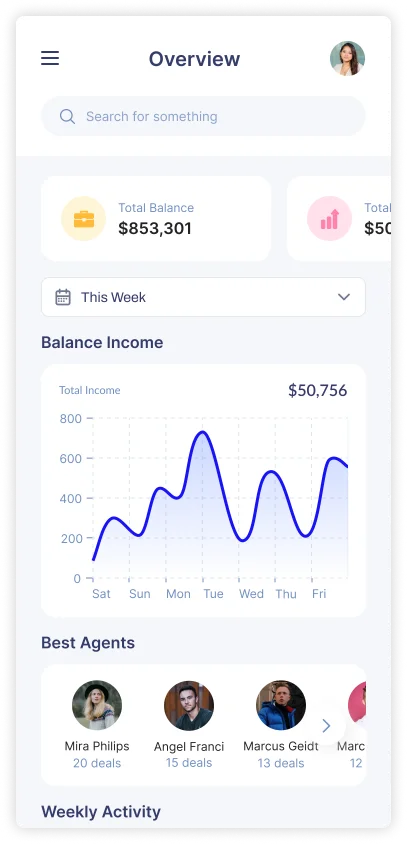

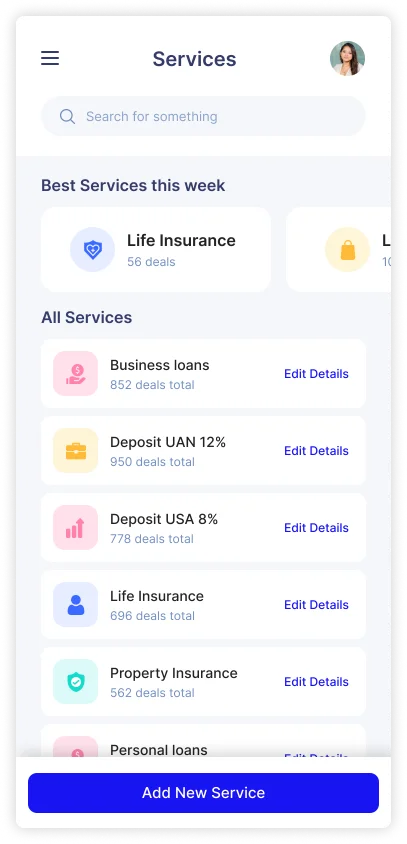

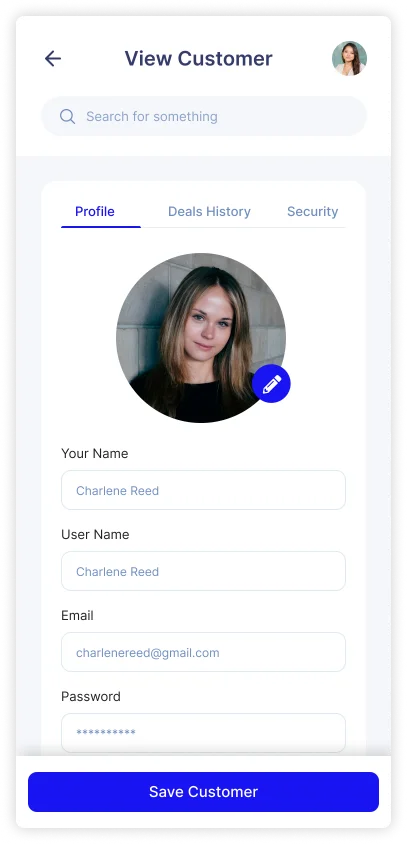

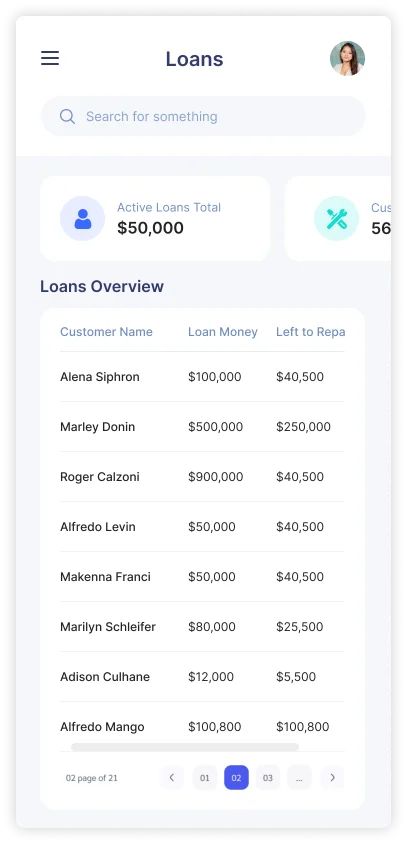

Adaptation of CRM for a microfinance organization to a mobile version

Each type of microfinance business has its own specifics, and therefore different tasks that CRM must solve. Depending on the direction, custom unique functions are implemented in the system.

Microfinance organizations that issue short-term loans require rapid decision-making and minimizing the risk of non-repayment. CRM for microloans includes tools that automate the process of client assessment and loan management:

Pawnshops handle valuable collateral and require strict accounting of each object, control of storage periods, and transparent sale of unclaimed collateral. The pawnshop program covers the entire cycle of working with collateral:

CRM example for a pawnshop

Credit cooperatives work with long-term loans and a complex membership structure, so CRM for a credit organization of this type includes blocks for managing not only finances, but also interaction with shareholders:

Online microfinance organizations and fintech startups operate in a digital environment where speed of application processing, high level of automation and customer convenience are critically important. CRM for online MFIs is built around digital service channels and integration with external services:

With us, you will receive a unique CRM system for a microfinance organization of any type, maximally adapted to the specifics of your business, which will provide flexibility, scalability, and full integration with the existing ecosystem.

For microfinance organizations, data security is not just a requirement, but the basis of customer trust and compliance with legislation. In individual CRM systems, we implement a complex of multi-level protection measures:

Security in CRM for microfinance organizations is an important part of the strategy that encompasses technological and legal components.

Developing an individual CRM system for a microfinance organization is a multi-stage process that requires deep expertise and attention to detail from developers. Our team adheres to a transparent and customer-oriented approach at each stage.

The first stage of developing a management system for a microfinance organization is an analysis of business processes, current tasks and strategic goals. Analysts delve into the specifics of the company’s work: they study how applications are processed, customer data is processed, payments, debts and communication methods are recorded. It is important to identify bottlenecks that slow down work or create risks, and to determine the goals of CRM implementation.

Based on the analysis, a technical task is formed – a key document that describes all the requirements for the future CRM system. The TOR fixes functional modules, integrations, user roles, usage scenarios, and data security requirements. Non-functional parameters are also determined here: performance, scalability, number of simultaneous users. The technical task is a project roadmap agreed upon by the development team with the customer, which eliminates misunderstandings and additional adjustments.

After the TOR is approved, the system architecture is designed: key CRM components are determined, their interaction, database selection, server architecture (monolith or microservices). Next, interactive screen prototypes are developed in Moqups, Figma, Axure, or Adobe XD to show the customer how the CRM will look and work before the project begins.

UX/UI design is the visual and functional part of the program. First of all, designers focus on usability – the system should be intuitive for all employees, provide quick navigation, a minimum number of clicks to complete tasks, and access to important data. The design takes into account corporate colors, brand book, as well as modern trends – minimalism, adaptability, lightweight interfaces without unnecessary overload. Special attention is paid to interfaces for mobile devices and tablets, so that the system remains convenient even outside the office.

Developing a responsive UI design for CRM in Figma

The key stage of CRM development for microfinance institutions is the creation of software code. To ensure fast work and a flexible interface, tools such as React, Vue.js, Angular are used for front-end development. The back-end is implemented in such programming languages as Python and Java, using the Node.js platform, frameworks and databases PostgreSQL, MySQL, MongoDB. REST API or GraphQL is used for data exchange. At this stage, integrations with external services are implemented, interaction with the database is configured and data protection is ensured (for example, through encryption, tokenization, OAuth).

After writing the software code, the system undergoes multi-level testing. QA engineers check the CRM for bugs, logic errors, and vulnerabilities. Comprehensive testing also includes load tests, checking the correct operation of integrations, security, and usability. The goal is to release a stable and reliable product that is ready to work even under extreme load conditions.

This stage includes transferring the CRM system for MFIs to a server or hosting it in the cloud, configuring domain names, SSL certificates, and databases. Final testing is carried out in real conditions, transferring data from old databases, and training employees. After the release, the CRM is gradually implemented so as not to interrupt business processes, but from the first day the system begins to save employees’ time and reduce your business’s costs.

Work with CRM does not stop there; the program requires technical support, updates, and scaling as the business grows. Feedback from users helps to track logs, troubleshoot problems, advise users, update libraries and server components to improve security after the system is launched. In parallel, work is underway to develop the system: add new modules, integrations, improve interfaces. This approach allows CRM to remain relevant and as valuable as possible for your business.

Creating an automated management system involves not only writing a program, but also a deep dive into business processes, legal requirements and the intricacies of financial transactions. It is better to order a CRM system for microfinance organizations from us, because we:

The AVADA MEDIA team does not just create software, but develops its own digital ecosystem for you that solves your problems, not creates new ones.

Does the CRM system for MFIs support the management of multiple legal entities or branches?

Within the framework of one CRM system for a microfinance organization, it is possible to keep records of several companies and branches in a single system, with individual settings for each business, including reports, users and financial indicators. This is very convenient for network MFIs, for which it is important to centralize management.

Is it possible to connect the system to POS terminals and cash registers?

Is it possible to ensure integration with POS systems and cash registers via drivers or API. Then all financial transactions will be recorded in CRM in real time. This simplifies accounting, cash management and reporting.

Can the program automatically generate reports for audits?

The CRM system for MFIs can automatically generate reports in accordance with the requirements of regulators, tax authorities or audit companies, export them in the necessary formats and even send them on a schedule.

Can I implement my own scoring rules in the program?

Individual scoring models can be configured, which allow you to set your own formulas, weighting factors and criteria for evaluating borrowers.

Does CRM support integration with messengers?

CRM can be integrated with popular messengers (WhatsApp, Telegram, Viber, Facebook Messenger, etc.) to maintain a dialogue with clients, send reminders, offers, and notifications directly from the system.

Can the system automatically extend contracts and accrue interest?

CRM can be equipped with functions for automatic extension of contracts, interest recalculation, and sending messages to clients. All processes will be performed according to set rules without operator intervention.

Is there control over loan issuance limits and automatic blocking?

In an individual CRM system, you can set limits by amounts, number of loans per day, client categories, regions, and other parameters, as well as automatic blocking of new issuances if these limits are exceeded.

Is it possible to integrate CRM with a call center and IP telephony?

Yes, CRM can be connected to Asterisk, Binotel, Zadarma so that calls are recorded directly in the client’s card, and conversation records are stored in the system.

How is CRM compliance with legal requirements ensured?

During development, current legal regulations (for example, GDPR, laws on personal data protection, requirements for microfinance organizations) are necessarily taken into account at the analysis and design stage, legally significant data protection mechanisms, encryption are implemented, user actions are audited and regular security testing is carried out.

How is the CRM program adapted for a pawnshop in Ukraine?

The program for the operation of a pawnshop is developed taking into account local legislation, the peculiarities of collateral accounting, work with customers and integration with cash systems.

Our works

Contact the experts Have a question?

Developed by AVADA-MEDIA™

The user, filling out an application on the website https://avada-media.ua/ (hereinafter referred to as the Site), agrees to the terms of this Consent for the processing of personal data (hereinafter referred to as the Consent) in accordance with the Law of Ukraine “On the collection of personal data”. Acceptance of the offer of the Consent is the sending of an application from the Site or an order from the Operator by telephone of the Site.

The user gives his consent to the processing of his personal data with the following conditions:

1. This Consent is given to the processing of personal data both without and using automation tools.

2. Consent applies to the following information: name, phone, email.

3. Consent to the processing of personal data is given in order to provide the User with an answer to the application, further conclude and fulfill obligations under the contracts, provide customer support, inform about services that, in the opinion of the Operator, may be of interest to the User, conduct surveys and market research.

4. The User grants the Operator the right to carry out the following actions (operations) with personal data: collection, recording, systematization, accumulation, storage, clarification (updating, changing), use, depersonalization, blocking, deletion and destruction, transfer to third parties, with the consent of the subject of personal data and compliance with measures to protect personal data from unauthorized access.

5. Personal data is processed by the Operator until all necessary procedures are completed. Also, processing can be stopped at the request of the User by e-mail: info@avada-media.com.ua

6. The User confirms that by giving Consent, he acts freely, by his will and in his interest.

7. This Consent is valid indefinitely until the termination of the processing of personal data for the reasons specified in clause 5 of this document.

Send CV

Contact us in any convenient way for you:

+ 38 (097) 036 29 32