Manual trading on trading platforms requires constant monitoring, analysis of huge amounts of data, and strict adherence to numerous rules. Mistakes caused by fatigue or emotions can be costly.

A high-quality crypto bot automates all key processes: instant execution of trades, a strict decision-making algorithm, and round-the-clock operation without human intervention. It is a tool that turns a strategy into a systematic and predictable source of profit.

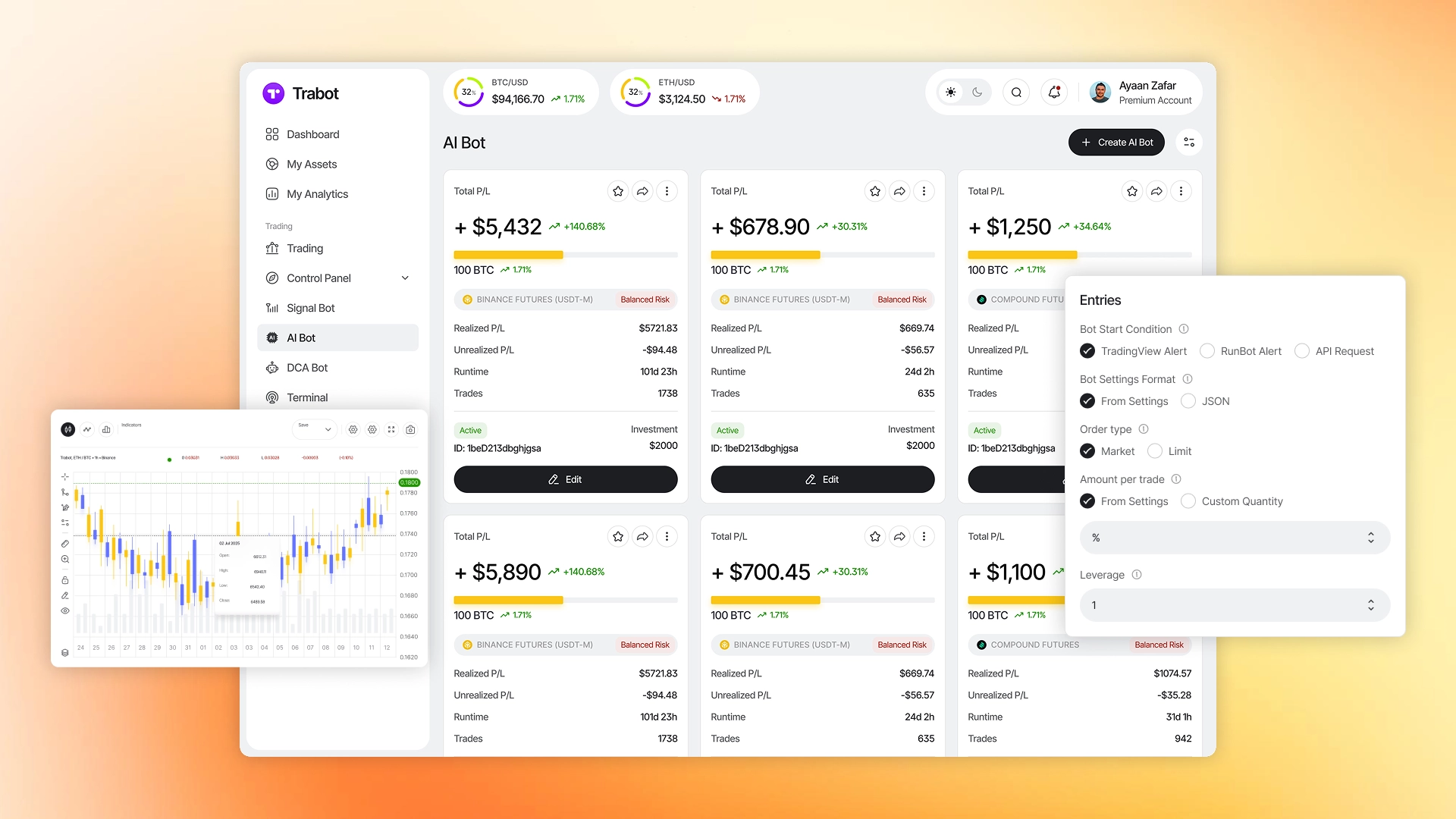

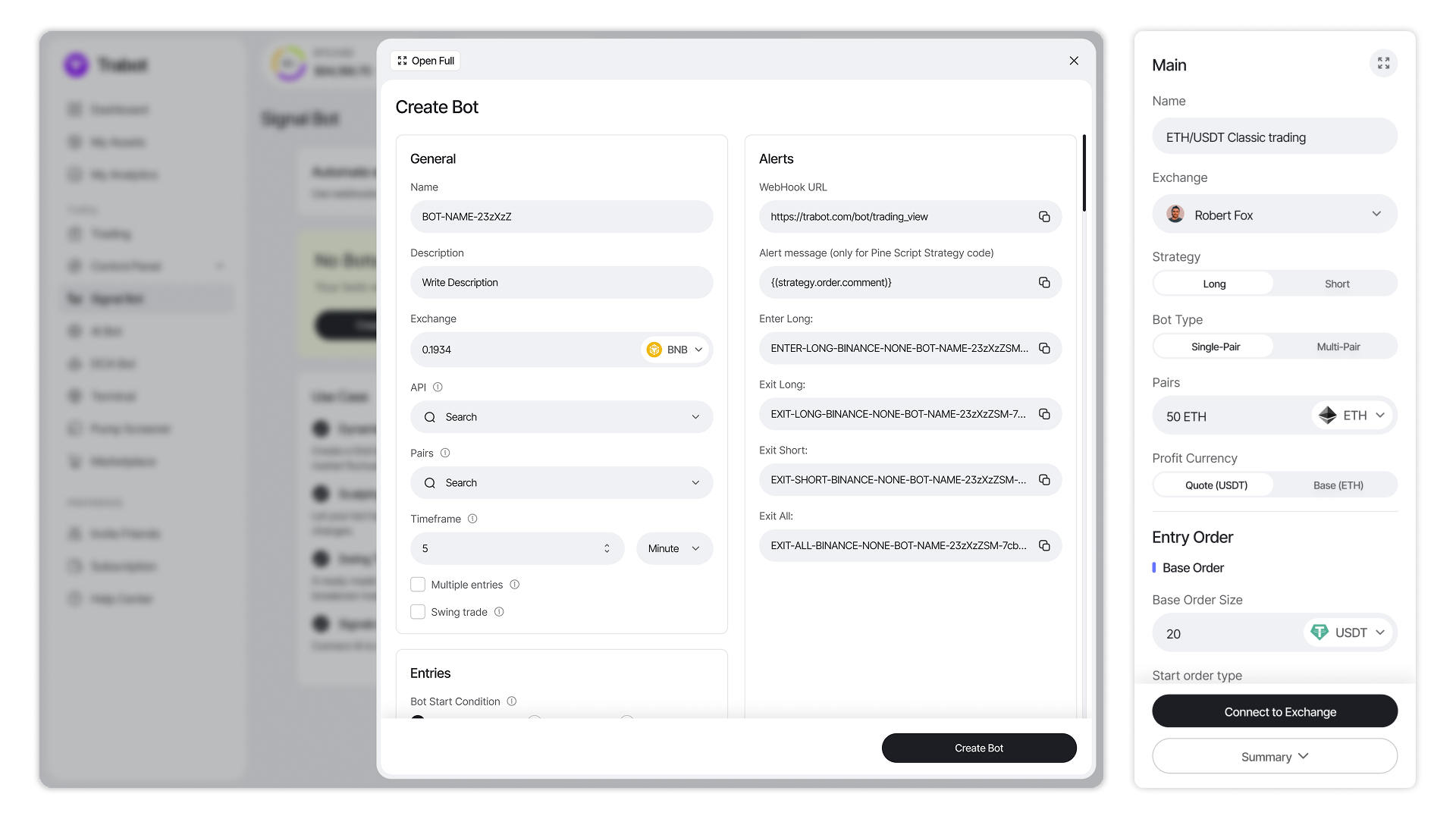

The development of custom trading bots for crypto exchanges is an area in which AVADA MEDIA has been working for many years. We create custom IT solutions that operate according to various algorithms, including around the clock, and make instant trades on the most favorable terms through multi-stage analysis of market dynamics across a variety of parameters. Proven algorithms, product adaptability, and the team’s industry experience are the key to the success of our clients’ strategies and stable income.

Examples of our latest work in this and related areas are available for review in our Portfolio. You can ask questions that interest you, learn how to scale your strategies to make them a round-the-clock source of income, and gain control over your results without stress here.

When trading on cryptocurrency trading platforms, some rely on RSI (relative strength index), others on OBV (on-balance volume indicator), and some act in the old-fashioned way, trusting their intuition. Whatever method you use, trading bots for cryptocurrency trading are a tool that will simplify your work, increase its efficiency, save time, and minimize the risks associated with the human factor.

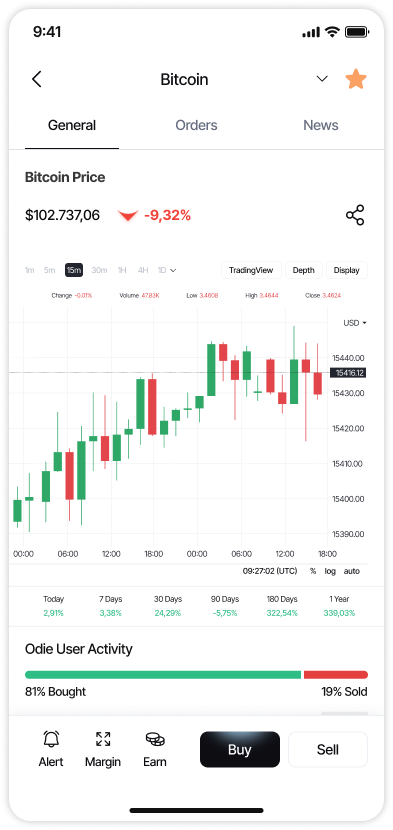

A crypto trading bot is a software solution that automates trading by executing trades according to predefined algorithms. The software analyzes the market of target exchanges, tracks signals and indicators, reacts instantly to fluctuations, and manages capital according to predefined rules. The system makes decisions about buying and selling assets based on data including the number of orders, time, trading volumes, and prices. The bot is capable of quickly processing huge amounts of data.

The software uses various algorithms: technical analysis (RSI, MACD, moving averages, etc.), relies on arbitrage strategies, grid orders, etc., depending on the results you are interested in and the methods used. There are two types of such tools.

A cryptocurrency bot can fully automate trading. For example, it “sees” that the price of the target asset has risen above the moving average, and if this is a signal to buy in its settings, it automatically places an order on the exchange, locks in profits when the price rises, and sets a stop loss to protect capital.

There are also types of software that assist in decision-making. What functions can the system perform:

All these options allow traders to see the picture more clearly, relying on objective data rather than emotions, react faster, and test hypotheses without risk. Unlike fully automated algorithms, such software leaves the final decision up to you rather than making it itself. It can send signals to Telegram, Discord, and other services.

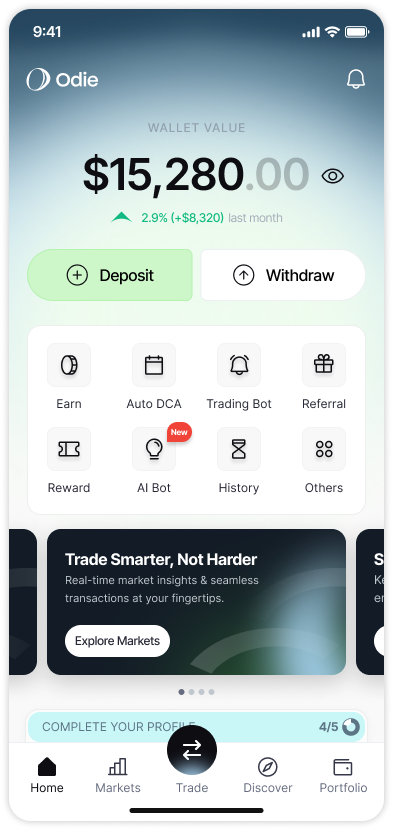

In addition to trading droids and bots, we also develop related tools. For example, our portfolio includes a mobile non-custodial crypto wallet and an investment cryptocurrency web platform. We can also implement other functionality that will be useful for both private traders and corporate organizations.

Software for trading

Modern financial platforms place high demands on traders–successful work on them is impossible without quick reactions, in-depth analysis of dozens of parameters, and emotional stability. With an automated trading system, you don’t need to constantly monitor the market, stress over missed opportunities, independently assess the significance of news, or compare indicators and price fluctuations.

Missed signals, fatigue, and the inability to stay at the monitor around the clock lead to stress and lost profits. With a high-quality tool, all these problems are eliminated.

What are the benefits of using bots for trading on exchanges?

The software works 24/7, without errors, emotions, or breaks, allowing you to use 100% of the market’s potential, even when you are asleep or busy.

The algorithm reacts to market changes in seconds, which is especially valuable when trading on volatile exchanges.

Your income does not depend on emotions, hasty decisions, or insufficient information – the program acts strictly according to a set algorithm, strictly following the chosen strategy, taking into account the current market situation.

The bot records results and keeps records, allowing you to adjust your strategy and increase your income based on the analysis of real, up-to-date data. Such software provides up to 90% accuracy thanks to various options, including approximation of collected information and exchange rate forecasting.

With a competent approach and high-quality technical execution, a cryptocurrency trading bot can pay for itself within 1-3 months, significantly increasing competitiveness in this market.

AVADA MEDIA team develops bots for cryptocurrency trading, adapting these tools and their functionality to the individual strategies, platforms, and trading style of each client. From simple scalping algorithms to complex arbitrage and trend analysis systems.

Creating custom software for trading on crypto exchanges is relevant for all financial market participants:

A couple of decades ago, programs for trading on stock and other markets were available exclusively to hedge funds due to the high cost of creating and maintaining such software.

Today, such solutions are available to all participants, including private traders and brokers. Moreover, such systems can be implemented with a unique set of options that take into account the specifics of specific strategies, trading styles, and target platforms. This includes monetization through SaaS platforms, commissions, marketplace formats, etc.

Custom development of trading bots by AVADA MEDIA meets the individual needs of each client, from optimizing personal techniques to comprehensive solutions for professional companies and effective trading scaling. Such IT solutions save time, increase the profitability of operations, and help to effectively manage risks.

Important. Trading bots can be configured with great precision and customization, reacting faster and more accurately than humans, free from fear or panic, and able to work simultaneously on multiple markets and platforms. But it is important to understand that an incorrectly set strategy, lack of control and updates (the market is very dynamic), as well as gaps in the software itself or the quality of the connection to the exchange you are interested in, still carry the risk of losses. That is why it is critically important to entrust the creation of crypto trading systems only to qualified specialists.

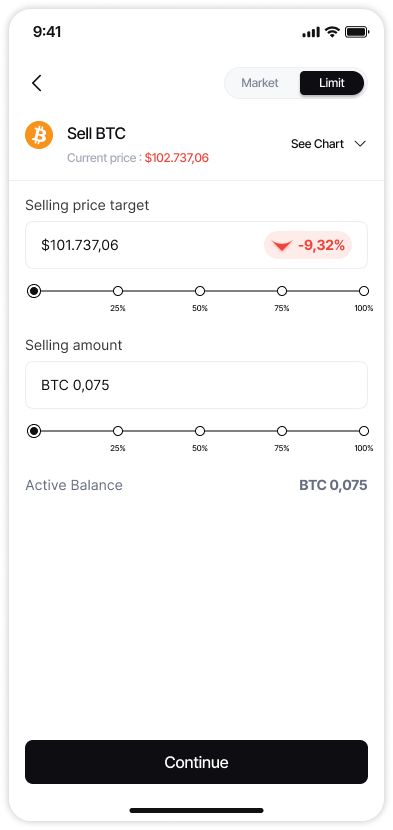

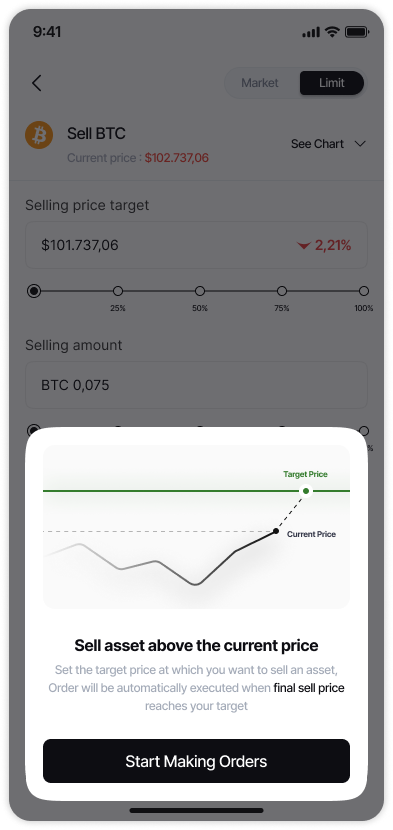

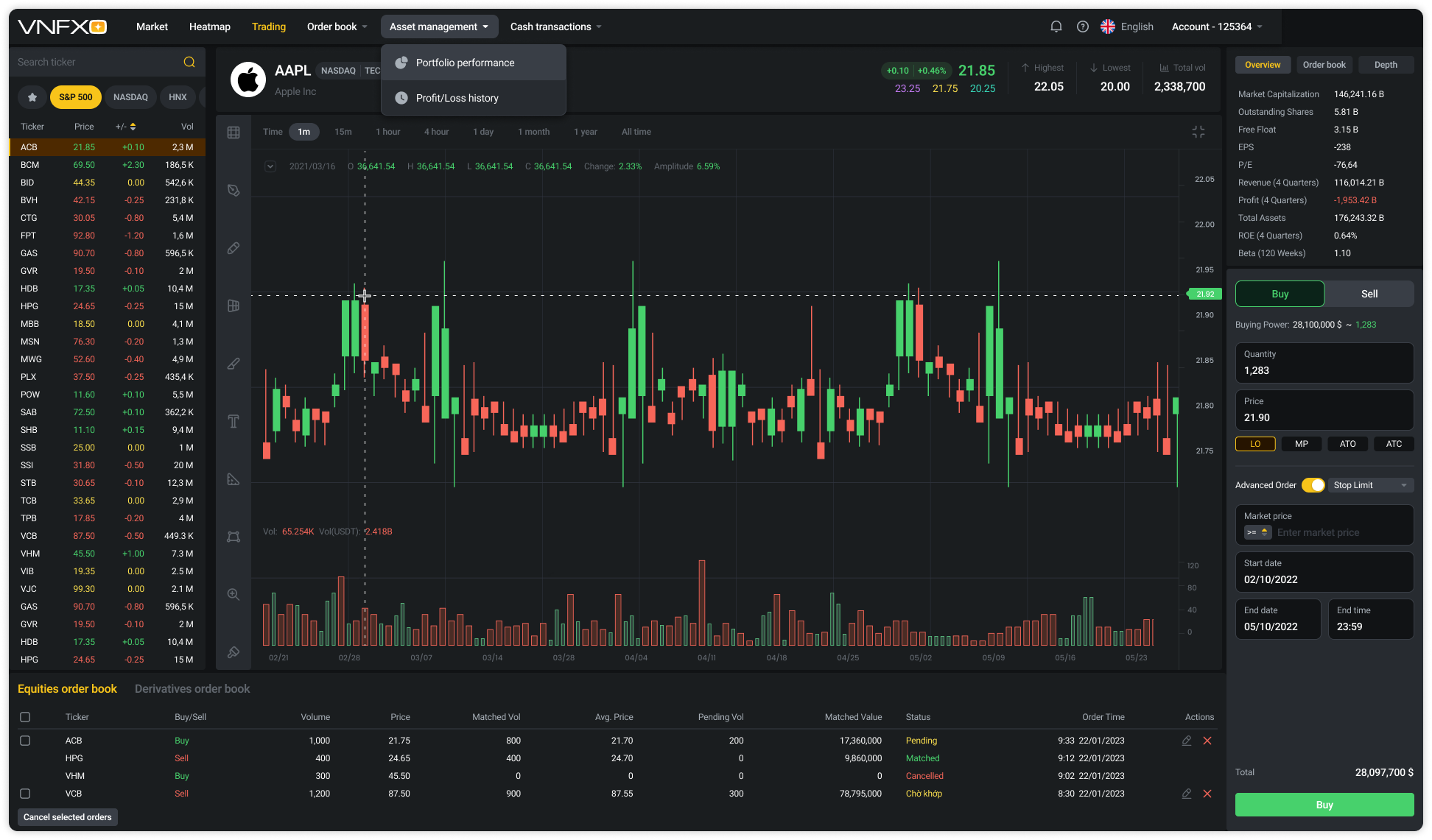

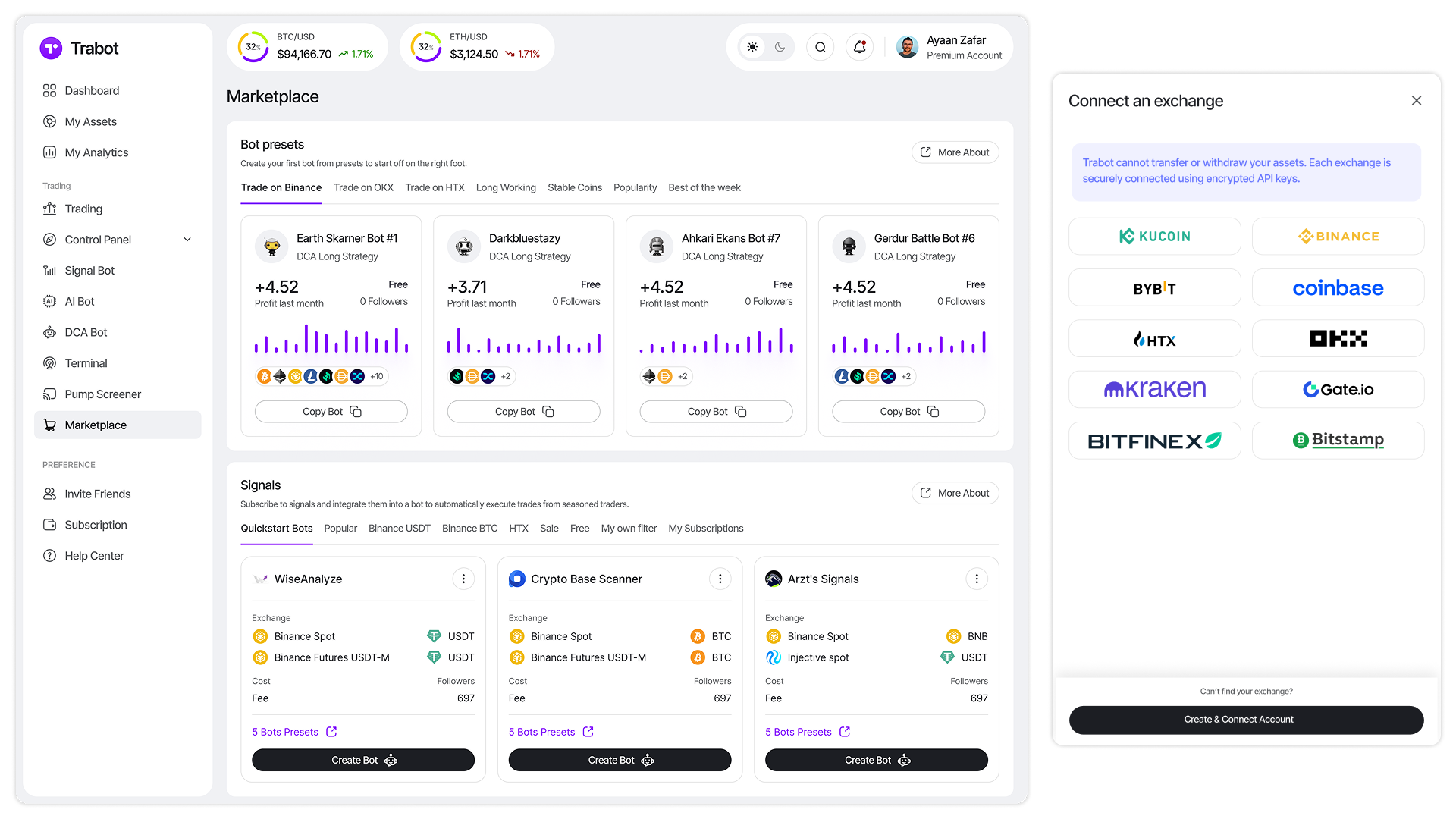

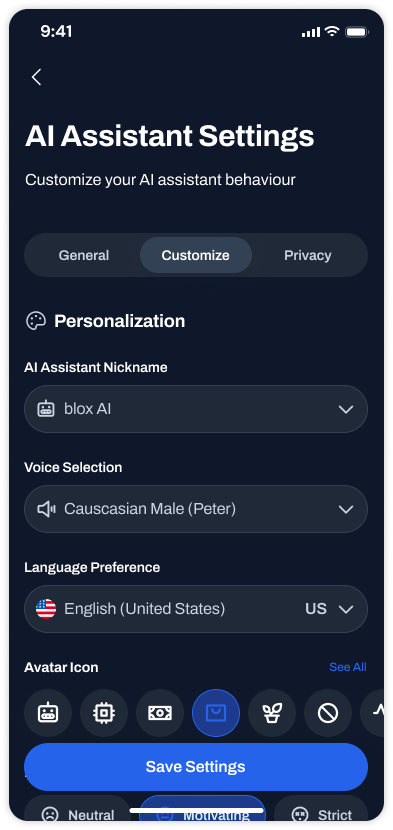

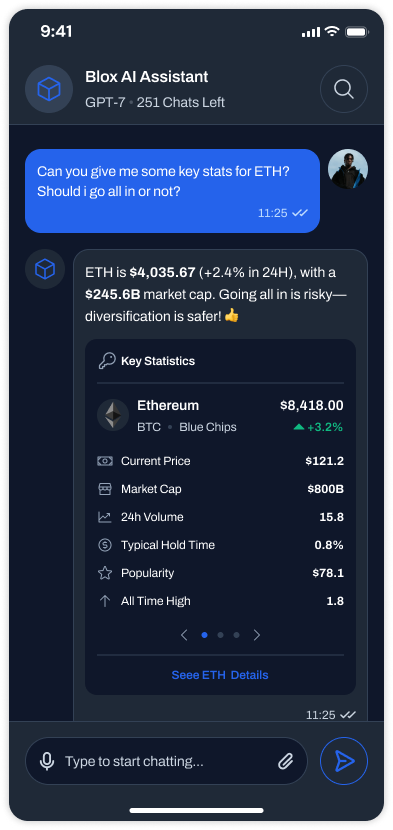

Mobile screens of the trading bot

We implement each trading bot on an individual basis to best match the client’s strategy and goals. The process goes through several key stages:

1. Data collection and analysis

We determine the client’s trading goals and strategies–the functionality, scale, and cost of the trading bot depend on the tasks the system will perform (arbitrage, scalping, etc.). We also study the target markets and platforms (their APIs, restrictions, commissions, response speed, etc.).

We form a list of necessary solutions–order support, risk management, working with different pairs, etc. We draw up technical specifications that reflect the technical and other requirements for the future product, deadlines, stack, and budget.

2. Architecture design

At this stage of trading bot development, the foundation of the future system is implemented, ensuring its accuracy and efficiency. The studio’s programmers determine the structure of the tool – modules for data collection, decision-making, signal processing, and order placement. Then they select programming languages and frameworks, and design databases for storing logs, quotes, and transaction history.

3. Development and testing on historical data

The next step is to create a trading algorithm for the selected indicators, signals, and risk management rules. The system is implemented and tested on historical data to assess its performance and effectiveness, identify and eliminate risks before interacting with real capital.

At this stage, trading logic is implemented and crypto bot strategies are programmed (technical analysis, indicators, machine learning, etc.), risk management is configured (loss limitation, take profit, stop loss). Specialists also implement monitoring and logging systems to record operations in a log, notify about events (successful trades, errors, connection failures, etc.), and visualize statistics via a dashboard or interface.

4. Integration with crypto exchanges

After successful testing on historical data, the bot connects to real trading platforms or exchanges specified in the technical specifications. It is implemented via API, with authorization, key protection, and market and limit order handling configured.

5. Testing and optimization

After successful connection to the target platforms, the crypto bot is tested on real markets without investing funds. Then, developers debug its functionality in real conditions on small volumes, optimizing response speed, algorithm performance, support for specified trading pairs, adding modules with advanced strategies, connecting to the customer’s internal/corporate systems (e.g., CRM), etc.

6. Launch and post-release support

Once the system is up and running as intended, the cryptocurrency trading/exchange bot is launched into full operation on a server or in the cloud. AVADA MEDIA developers instruct the client and/or their team, provide technical documentation and access. After release, our team can also support the project, adjusting its operation to market changes or client strategies, and adding functionality. This guarantees effective long-term solutions, taking into account industry dynamics and/or crypto exchange rules.

A phased, iterative approach to the development of trading crypto bots, as well as regular optimization of algorithms, ensures the reliability, stability, and security of the system, which best meets the strategies and goals of the customer.

Creating an effective trading bot requires professionalism, as well as the use of proven tools and up-to-date technologies. The speed, accuracy, and performance of the product depend on the choice and combination of software and IT solutions.

What stack do we use:

The right combination of programming languages, libraries, and integration systems ensures customization, scalability, and seamless implementation of the trading system into your processes, increasing their efficiency, security, and profitability.

A crypto bot can be developed to solve various tasks. Such software increases control over your portfolio thanks to its flexibility–it can adapt to the conditions and specifics of any market and works autonomously. Depending on your needs, the system can analyze market data, track signals and indicators, quickly execute trades, and manage capital according to specified conditions.

There are many types of such software:

As we can see, automated trading offers a multitude of optimization options, a whole ecosystem of strategies, from simple scalping to large-scale AI analytics. There is no single universal solution that is 100% successful. Thanks to its extensive experience in web development, AVADA MEDIA team can help you choose the right strategies for trading bots for the markets you are interested in, specific exchanges, and your trading style.

AI crypto bot

The AVADA MEDIA web studio team creates various software for trading on stock markets, from signal crypto bots for Telegram to complex systems with machine learning and extensive functionality. Below is a list of popular trading platforms for which we develop such IT solutions.

The international OKX platform offers a wide range of instruments, from spot, futures, and options to perpetual swap contracts. It supports sub-accounts and has a developed API. At the same time, the platform sets limits on the frequency of requests, which is important to consider when implementing high-frequency trading strategies, and has its own specifics for derivatives (margin, leverage, cross/isolated modes).

The bot must be able to automatically close trades at risk of liquidation, recover, and reconnect when the connection is lost. Logs and alerts are critical, and the exchange requires the use of an accurate timestamp and signing of requests. Read about these and other features of implementing OKX trading bots on this page.

The European platform WhiteBIT has serious requirements in terms of regulation and security. The platform focuses on spot and margin trading, perpetual futures are also available, but the range of derivatives is more modest compared to other exchanges.

The API is well-developed and supports HMAC-SHA512 authentication. If speed limits are exceeded, bots may be temporarily blocked, which is critical when using certain strategies. Therefore, it is important to carefully integrate risk management into the system. The platform does not provide a full-fledged testnet. There are fewer advanced orders compared to OKX and Binance – bots for WhiteBIT are easier to implement but less flexible when it comes to setting up trading strategies. Read more about the nuances of creating such systems on this platform here.

Binance is the largest international crypto platform in terms of trading volume, demonstrating high liquidity on almost all pairs. The platform offers a wide range of instruments: spot, futures, options, staking, P2P, and DeFi instruments. It has a complex, developed API for prices, accounts, orders, and a separate Binance Futures API, which opens access not only to trading but also to market depth, liquidity, candlesticks, and indicators. It supports a wide variety of order types (market, limit, OCO, etc.), has request limits, and strict API authorization.

When creating a trading bot for Binance, it is important to consider various speed restrictions, and the system must clearly distinguish between spot and futures methods. Due to high liquidity and leverage of up to x125, it is important to configure stop losses and limits in detail, as well as protect against price spikes. A retry option is also necessary–under high loads, the service may return an HTTP 429 error. You can read about how we develop trading bots for Binance by following the link.

This is one of the top platforms, offering more than 700 trading pairs, including spot, futures, margin, P2P, and Earn products. In addition to REST and WebSocket, the resource supports public data (order book, candles, transactions), as well as private operations (orders, balance, account), plus built-in Kucoin trading bots from the platform itself are available. When creating your automated solutions, it is important to consider the limitations on the number of requests and the separation of the API for futures.

There are many illiquid altcoins on the platform, so the software must check the volume before entering a trade. Due to the volatility of small pairs, it is important to implement stop-loss, trailing, and slippage protection features. In case of connection instability, the system needs a function for repeated requests and backup strategies. You can learn more about how we develop crypto bots for Kucoin here.

In addition to the exchange, the Crypto.com ecosystem includes DeFi wallets, Visa cards, and Earn programs. You can trade here using spot, margin, and derivatives. In addition to REST and WebSocket, the platform supports market data and private methods. When developing software for it, it is important to consider that it has licenses in various jurisdictions and uses the CRO token for staking, discounts, and commissions.

The trading software architecture must also provide for separate endpoints for spot and futures. And if you plan to use private methods, you will need HMAC signatures with a secret key. Liquidity varies, so the bot must check the volume and spread. At the same time, volatility is high, API delays are possible – it is important to consider options for repeat requests, stop orders, and fail-safe logic.

We create Crypto.com bots for Telegram and mobile devices and implement cloud solutions. Read more about the options, advantages, and stages of developing such software on this page.

This is one of the oldest platforms. It offers spot, margin trading, and derivatives. The selection of altcoins is quite large, but liquidity is uneven – the bot needs to check volumes. REST and WebSocket are used for market data, as well as balance and order management. WebSocket is preferable for obtaining quotes and transactions, as there are speed limitations in the REST API.

When using private methods, an HMAC-SHA256 signature is required. API key permissions can be restricted, for example, to trading without withdrawal. In the architecture of a trading bot for the Poloniex exchange, you need to take into account the difference between API endpoints for spot and futures. The platform does not offer a separate sandbox environment for testing, which is also important to keep in mind. The software must automatically reconnect and restore its state in case of failures. You can read more about how to create automated software for trading on Poloniex here.

The main advantage of custom development of trading bots for trading on crypto exchanges is that they can be tailored to the client’s strategies and take into account the specifics of the target platforms–their architecture, variety of tools, technical limitations, and security requirements. As a result, you get the most effective IT solution for specific tasks and platforms.

AVADA MEDIA web studio team has been professionally engaged in the individual development of digital solutions and the creation of custom crypto trading bots for many years. We are among the best blockchain developers in Ukraine. We implement CRM, ERP, SaaS, websites, mobile applications, and bots for business automation. With us, you get a reliable partner.

Advantages of ordering crypto trading software from AVADA MEDIA:

If you are looking for a high-quality solution for automating your work with crypto exchanges, leave a request or contact us directly to discuss the details. Thanks to advanced technologies and deep industry expertise, we will help you turn your trading strategy into an effective, reliable source of income.

How much does it cost to develop a trading bot?

The project budget depends on the tasks that the system must perform and its scale. The price of creating a trading bot is influenced by the logic and architecture of the product—it is necessary to implement a tool for arbitrage or trading with stop limits, specifically for cryptocurrencies or currency quotes, and which exchanges or brokerage platforms will be connected. If a SaaS product is required, the cost will be higher.

Which is better – a standard solution or developing your own custom bot?

Custom software is fully adapted to your strategies and target exchanges and does not require paying commissions to third-party services. It allows you to scale your income and optimize functionality according to market dynamics, and even license the system for use by other traders, generating additional income.

Ready-made bots often do not meet all needs 100%. Using functional standard systems can ultimately be more expensive than custom development, and using cheap alternatives carries a number of risks. Creating your own bot eliminates these risks, providing comprehensive asset protection. There is also an intermediate, hybrid solution, which you can learn more about on the White Label crypto bot for trading page.

Do I need to monitor the bot constantly?

Constant monitoring (24/7) by the trader is not really necessary if the bot works according to algorithms, but there are some nuances. The decision can be fully or partially automated (for example, signal bots only report data, and the trader makes the decision). You can order software that will monitor the market around the clock and execute trades according to specified algorithms without your involvement.

But it is important to remember: the crypto industry is very dynamic — for maximum efficiency, you need to monitor the software’s performance and adjust strategies as necessary in any case, which is available through the analytics panel and reports.

How long does it take to develop a trading bot?

The timeframe depends on the complexity of the strategy and functionality that needs to be implemented. Simple software can be ready within 2-6 weeks. Developing large-scale SaaS options with architectural composition elements and custom logic takes 4-6 months.

Which exchanges will my bot support?

It depends on your goals and strategy. We develop trading bots for many popular crypto exchanges, including Binance, KuCoin, OKX, Whitebit, Crypto.com, and Poloniex. If you are interested in automating trading on other platforms, please contact us to discuss your requirements.

How does the bot manage risks?

Cryptocurrency trading bots manage risks using built-in strategies and control tools. Key mechanisms that are implemented in various combinations depending on the architecture and specifics of the software:

In other words, a trading bot manages risks in the same way as an experienced trader, only in automatic mode and without emotions.

Is it possible to test a strategy before making real trades?

Yes, we conduct backtesting (testing on historical data), paper trading (demo trading), and real trading with a small deposit (depending on the project). The availability of these types of testing also depends on the policy of the exchange for which the system is being developed.

How will I receive reports and see the bot's performance results?

The products we develop provide detailed reports on all transactions, strategy effectiveness, and capital management. This helps you make informed decisions, optimizing your trading, increasing its profitability, predictability, and security.

Contact the experts Have a question?

Developed by AVADA-MEDIA™

The user, filling out an application on the website https://avada-media.ua/ (hereinafter referred to as the Site), agrees to the terms of this Consent for the processing of personal data (hereinafter referred to as the Consent) in accordance with the Law of Ukraine “On the collection of personal data”. Acceptance of the offer of the Consent is the sending of an application from the Site or an order from the Operator by telephone of the Site.

The user gives his consent to the processing of his personal data with the following conditions:

1. This Consent is given to the processing of personal data both without and using automation tools.

2. Consent applies to the following information: name, phone, email.

3. Consent to the processing of personal data is given in order to provide the User with an answer to the application, further conclude and fulfill obligations under the contracts, provide customer support, inform about services that, in the opinion of the Operator, may be of interest to the User, conduct surveys and market research.

4. The User grants the Operator the right to carry out the following actions (operations) with personal data: collection, recording, systematization, accumulation, storage, clarification (updating, changing), use, depersonalization, blocking, deletion and destruction, transfer to third parties, with the consent of the subject of personal data and compliance with measures to protect personal data from unauthorized access.

5. Personal data is processed by the Operator until all necessary procedures are completed. Also, processing can be stopped at the request of the User by e-mail: info@avada-media.com.ua

6. The User confirms that by giving Consent, he acts freely, by his will and in his interest.

7. This Consent is valid indefinitely until the termination of the processing of personal data for the reasons specified in clause 5 of this document.

Send CV

Contact us in any convenient way for you:

+ 38 (097) 036 29 32