Initially, the term fintech was used to describe organizations that create software in the field of working with money. From the field of application of new technologies has expanded and went beyond purely financial. At present, fintech technologies are also widely used in the field of insurance, trade and risk management.

Having seen the competitive advantages of new startups, traditional banking institutions began to actively introduce fintech into their own activities. Oschadbank, Privatbank, Mono Bank, FUIB, Ukrsibbank and other Ukrainian banks are actively introducing computer-based technologies, which allows attracting new customers and reducing business costs. . The same work is carried out by other banks in the world.

Financiers were the first to use fintech technology, but now such software solutions are increasingly being implemented in other areas of the business. In any business in which cash settlements take place, you can use fintech technology. Various cash settlements are made almost everywhere: in public utilities, OSMD, state bodies. And everywhere, the use of fintech technologies improves work efficiency.

That is why Ukraine is implementing a program of digital transformation of the state. If it is implemented, most of the public services can be received via the Internet. There will also be government cash settlements (tax payments, subsidies, etc.). If cash settlements are carried out in your business, the use of new fintech technologies can always increase the efficiency of your business, and Avada Media is ready to help you with this.

Fintech is such a new direction in business that there is not even a generally accepted definition for it. From the point of view of the type of activity, fintech can be defined as a new financial industry built on the use of the latest IT technologies for data collection and processing. From the point of view of the products used, fintech are new applications, including mobile ones, processes, and business models, used primarily in the financial sector.

Fintech technologies use the latest scientific achievements in the field of: collecting and processing big data, artificial intelligence, robotics, distributed registries, cloud technologies, biometrics, mobile technologies. Currently, fintech is most widely used in the financial sector. But similar technologies can increase efficiency in those industries where financial turnover is not the only component of business processes. That is, such technologies can be effectively applied in any organization. Avada Media has the experience of such developments and is ready to offer business system software solutions.

Naturally, the use of new IT technologies should pay off by gaining new advantages, and fintech offers such advantages. These include:

Fintech-technology allows you to issue loans, sell insurance policies and products, make any calculations continuously at high speeds.

The list of possible benefits of using fintech technology is not complete. Contact Avada Media to find out exactly what business benefits you can get.

The cost of software development depends on the volume of tasks. The development of Internet banking is a very large-scale and rather expensive project, as it requires long-term work of qualified specialists. If you need a small application, labor will be required less, the cost of such a project is available even for small businesses.

The exact price of a fintech solution can only be calculated on the basis of a detailed technical specification. The development of such a task also takes time and is relatively expensive. Therefore, when ordering a software product, they usually focus on the hourly wages of developers. One project can be executed simultaneously by several specialists, this reduces the time required to bring it to readiness.

Avada Media has been developing and implementing high-quality software products for over 9 years. During this time, our clients have become companies not only from Ukraine, Russia and the CIS countries, but also Australian, American, and European firms. Our programs work great, and many of our customers come on the recommendation of friends.

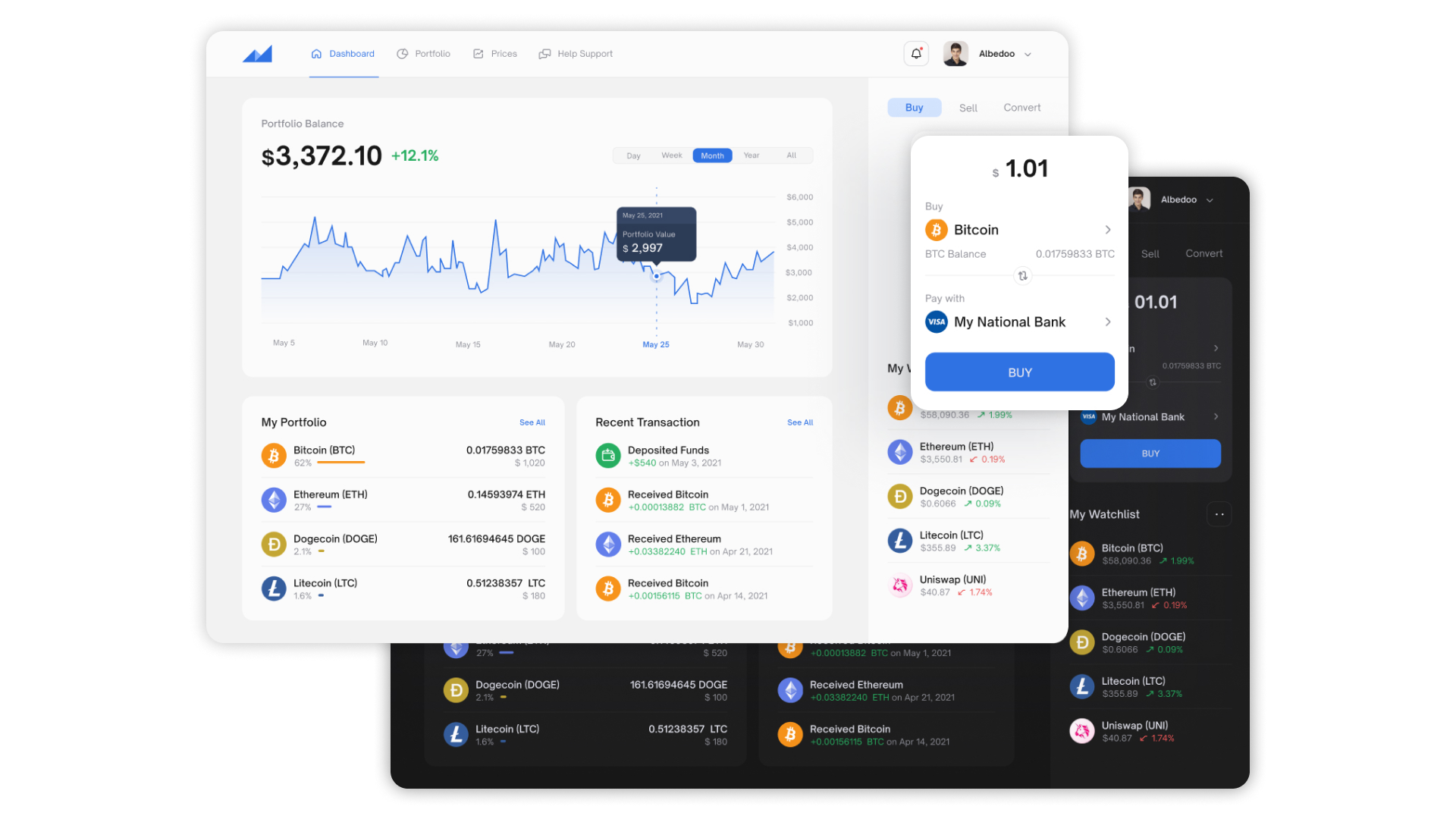

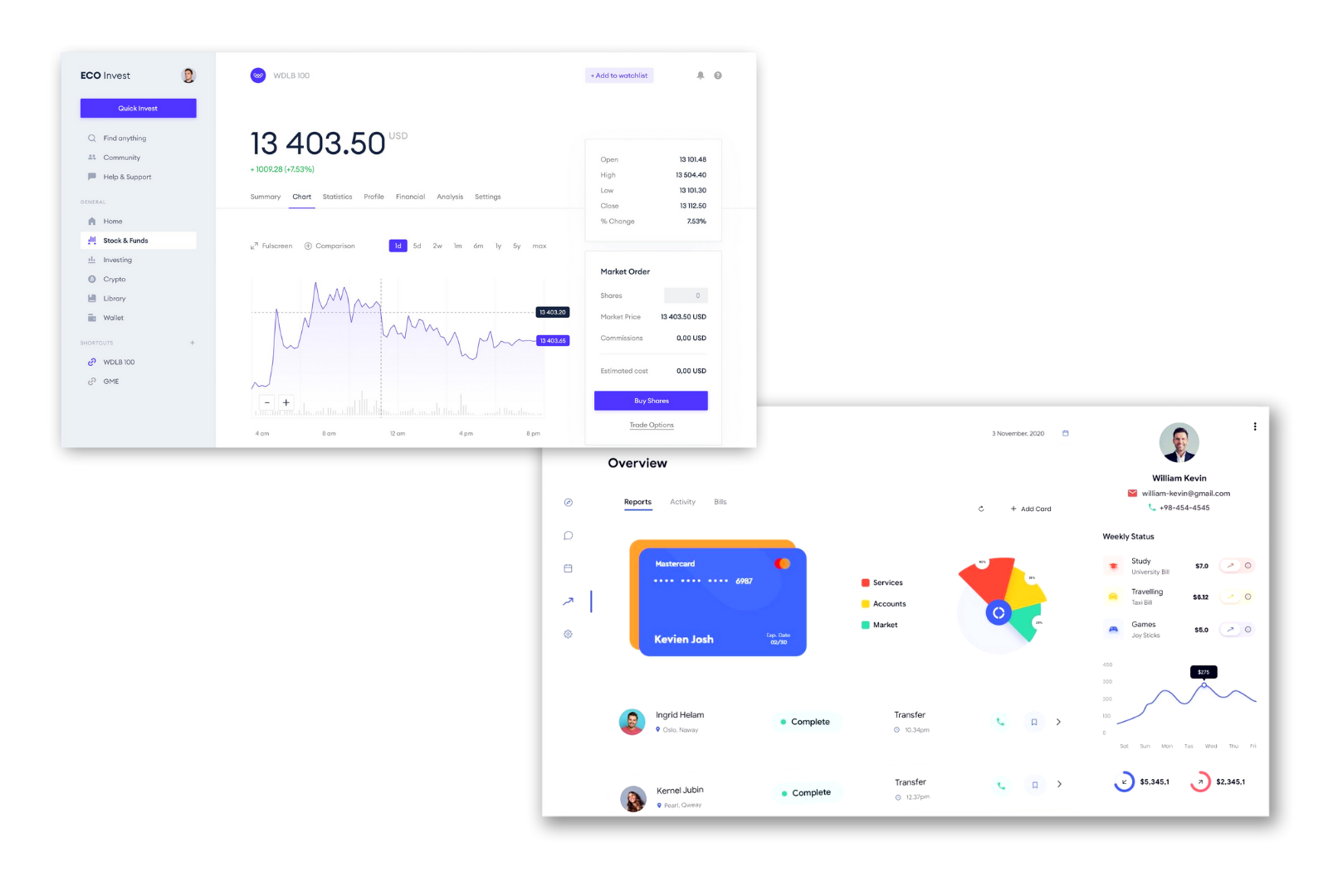

Avada Media has experience in creating software for fintech of any complexity, from complex banking sites with the ability to create personal dashboards for clients with the function of managing accounts (Internet banking), using a computer or mobile devices to small and relatively simple applications.

We are ready to provide the following types of services:

Order software at Avada Media and all your fintech ideas will come true.

Contact the experts Have a question?

Developed by AVADA-MEDIA™

The user, filling out an application on the website https://avada-media.ua/ (hereinafter referred to as the Site), agrees to the terms of this Consent for the processing of personal data (hereinafter referred to as the Consent) in accordance with the Law of Ukraine “On the collection of personal data”. Acceptance of the offer of the Consent is the sending of an application from the Site or an order from the Operator by telephone of the Site.

The user gives his consent to the processing of his personal data with the following conditions:

1. This Consent is given to the processing of personal data both without and using automation tools.

2. Consent applies to the following information: name, phone, email.

3. Consent to the processing of personal data is given in order to provide the User with an answer to the application, further conclude and fulfill obligations under the contracts, provide customer support, inform about services that, in the opinion of the Operator, may be of interest to the User, conduct surveys and market research.

4. The User grants the Operator the right to carry out the following actions (operations) with personal data: collection, recording, systematization, accumulation, storage, clarification (updating, changing), use, depersonalization, blocking, deletion and destruction, transfer to third parties, with the consent of the subject of personal data and compliance with measures to protect personal data from unauthorized access.

5. Personal data is processed by the Operator until all necessary procedures are completed. Also, processing can be stopped at the request of the User by e-mail: info@avada-media.com.ua

6. The User confirms that by giving Consent, he acts freely, by his will and in his interest.

7. This Consent is valid indefinitely until the termination of the processing of personal data for the reasons specified in clause 5 of this document.

Send CV

Contact us in any convenient way for you:

+ 38 (097) 036 29 32