In the financial sector, artificial neural network (ANN) technology has begun to move from being piloted to becoming a global industry. Already, neural networks are widely used to automate business processes, predict markets, improve customer interaction, and many other purposes.

In this article, we propose to talk in more detail about the areas of practical application of technology in fintech.

First of all, we propose to understand what neural networks are and how the principle of their work works.

By definition, neural networks are one of the methods of artificial intelligence that trains computers to process data in the same way as the human brain. To perform its functions, ANN uses special digital nodes in a layered structure that can be compared to organic neurons, which allows computers to learn from their mistakes and constantly improve.

The architecture of a basic neural network consists of three layers of interconnected neurons:

Having dealt with what neural networks are, we can proceed to an overview of their practical application in the field of finance. There are many options here, so we will only cover the most common ones.

Scoring

Neural networks are able to quickly analyze large amounts of data and independently make decisions on issuing loans from banks. If in the past manual scoring could take 2-3 weeks, then thanks to ANN, processing of customer applications is carried out in a matter of minutes. It is important that neural networks provide not only fast, but also more accurate results, reducing the share of overdue debts to almost a minimum.

Antifraud and financial monitoring

Neural networks are able to detect atypical behavior in bank accounts and effectively counteract financial fraud. One example of the practical application of the technology is the “Consumer Fraud Risk” tool from the payment giant Mastercard. It uses ANN-based artificial intelligence that analyzes payment data in real time and blocks fraudulent transactions before the funds leave the victims’ accounts. And this case is not the only one of its kind.

Maintenance of ATMs and TSOs

AI based on neural networks predicts the loading of ATMs and self-service terminals, which significantly reduces cash collection costs and improves the quality of customer service.

Document processing

When opening accounts and conducting banking operations where identity verification is required, neural networks are able to automatically enter customer data into the financial institution’s software package and check their correctness. Thus, ANNs can recognize over 70 details from scans and photos in a matter of seconds, which significantly reduces the operational burden on staff and speeds up service.

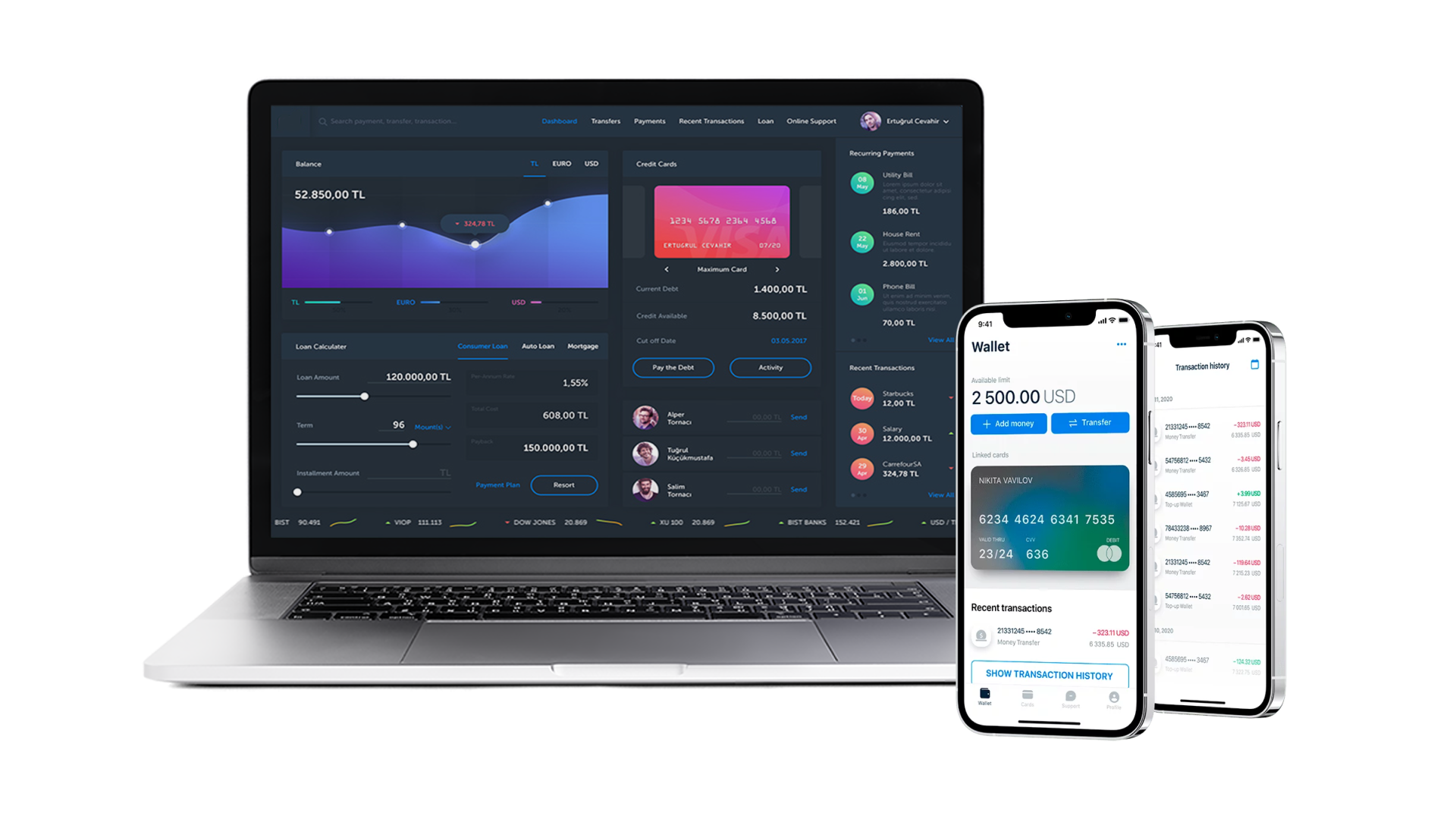

Personalization of offers of financial services

Banks and other financial institutions may offer dozens of different financial products and services, while serving hundreds of thousands and even millions of customers. In such a situation, it is quite difficult to make personalized offers, which can negatively affect sales conversion.

Neural networks effectively correct this situation. They analyze the behavioral patterns of clients and their interests in financial products, and, based on mathematical calculations, offer services that are most likely to interest a particular person.

Analysis of financial markets

The use of neural networks in financial investments allows traders to develop more efficient and profitable trading strategies based on a thorough analysis of the markets. For example, they can be used to find companies that have the potential for repeat high growth, or companies with similar fundamentals that are more likely to follow the same development path.

In addition, neural networks are often used to predict financial indicators, such as exchange rates or stock prices. To do this, they analyze a large amount of historical data, which allows you to get reasoned and most accurate results.

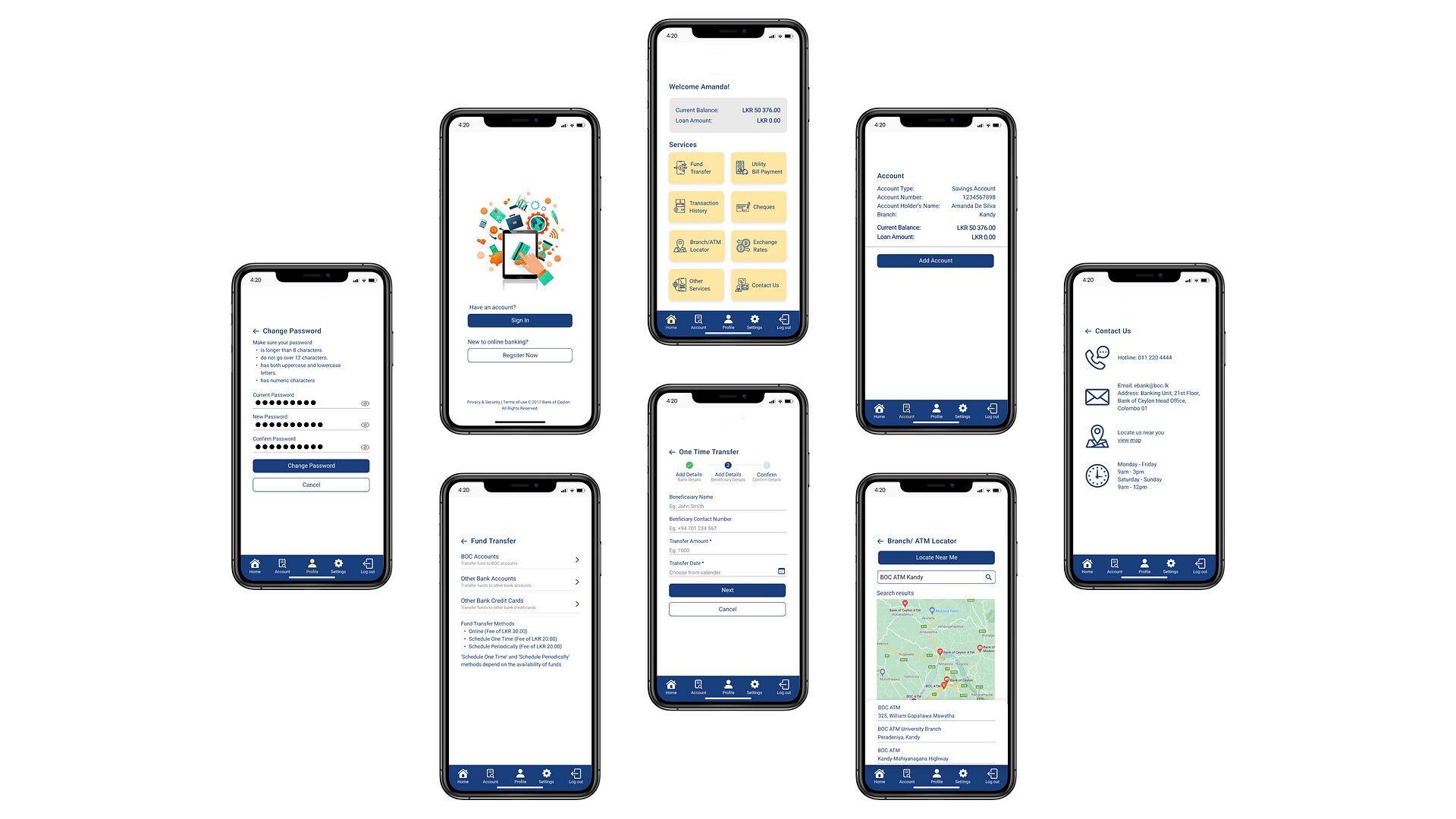

Launching voice assistants and chatbots

Banks and other financial institutions traditionally use call centers to help resolve customer disputes and improve the quality of their service. However, maintaining a large number of operators requires serious and constant investments, which is why companies are increasingly starting to give preference to launching automated voice assistants and chat bots based on neural networks.

Such tools are able to take over the processing of the overwhelming number of customer requests. Accordingly, a business can reduce call centers with live operators to a minimum – they will only have to solve atypical and complex problems.

Neural networks have become an integral part of the modern financial sector. They allow companies to automate many business processes, improve customer service and increase their reputation through the introduction of innovative technologies. According to analysts’ forecasts, over time, the share of neural networks in the field of finance will only expand, so now is the best time to invest in this area.

Our company provides services for the development, training and implementation of neural networks in companies in the financial sector. To work on such a project, we can provide already formed teams of experienced specialists. They will study your needs, find the best technical solution and make it a reality.

Contact the experts Have a question?

The user, filling out an application on the website https://avada-media.ua/ (hereinafter referred to as the Site), agrees to the terms of this Consent for the processing of personal data (hereinafter referred to as the Consent) in accordance with the Law of Ukraine “On the collection of personal data”. Acceptance of the offer of the Consent is the sending of an application from the Site or an order from the Operator by telephone of the Site.

The user gives his consent to the processing of his personal data with the following conditions:

1. This Consent is given to the processing of personal data both without and using automation tools.

2. Consent applies to the following information: name, phone, email.

3. Consent to the processing of personal data is given in order to provide the User with an answer to the application, further conclude and fulfill obligations under the contracts, provide customer support, inform about services that, in the opinion of the Operator, may be of interest to the User, conduct surveys and market research.

4. The User grants the Operator the right to carry out the following actions (operations) with personal data: collection, recording, systematization, accumulation, storage, clarification (updating, changing), use, depersonalization, blocking, deletion and destruction, transfer to third parties, with the consent of the subject of personal data and compliance with measures to protect personal data from unauthorized access.

5. Personal data is processed by the Operator until all necessary procedures are completed. Also, processing can be stopped at the request of the User by e-mail: info@avada-media.com.ua

6. The User confirms that by giving Consent, he acts freely, by his will and in his interest.

7. This Consent is valid indefinitely until the termination of the processing of personal data for the reasons specified in clause 5 of this document.

Send CV

Contact us in any convenient way for you:

+ 38 (097) 036 29 32